Video

Parallel Session 4

Transparency and accountability of market actors are key in assessing and, over time, enhancing the alignment of commercial with societal objectives. Measurement allows us to act and to track progress. Over the last decade, tremendous progress – both voluntary and regulatory – has been made on improving and standardizing corporate ESG disclosure practice in the real economy. The ESG-related impacts and risk exposures of financial institutions, however, too often remain enclosed in a black box. Following the lead of the Task Force on Climate-Related Financial Disclosures this session will examine the need for, and feasibility of, standardizing ESG disclosure in the financial sector; it will also discuss the private and public benefits – and costs – of achieving fuller ESG transparency from the world’s financial markets.

Slides

Moderator

|

Jane Stevensen Engagement Director to the Task Force for Climate-related Financial Disclosures, CDP and CDSB, United Kingdom |

Speaker

|

Jacki Johnson Group Executive of People, Performance & Reputation, IAG Executive Director of IAG NZ, Australia |

|

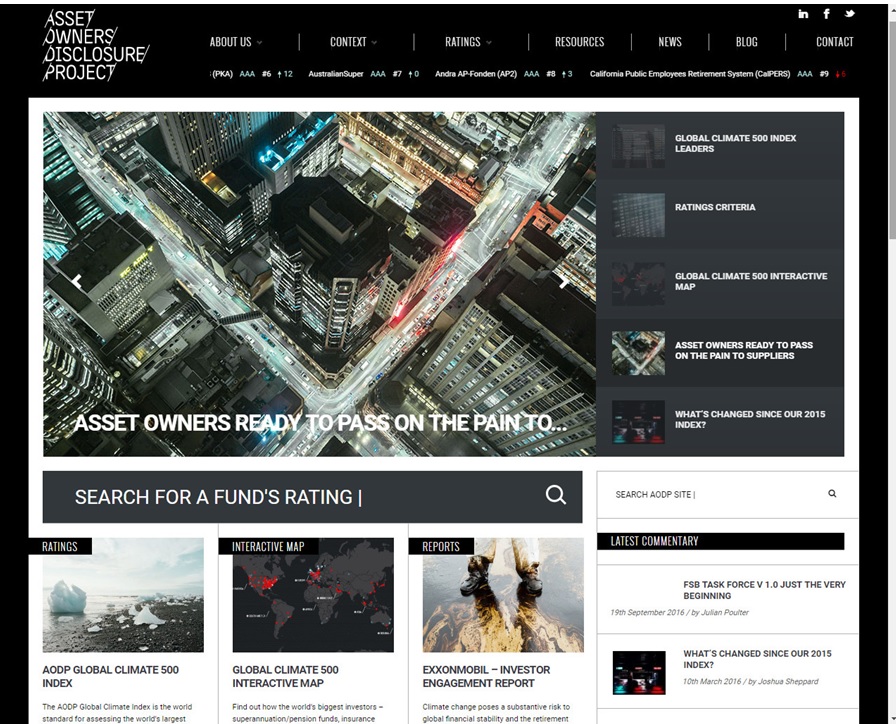

Julian Poulter Chief Executive Officer, Asset Owners Disclosure Project (AODP), United Kingdom |

|

Namita Vikas Phadnis Group President & Managing Director, Climate Strategy & Responsible Banking, YES BANK LTD, India |

|

Jon Williams Partner, Sustainability & Climate Change, PwC, United Kingdom |