For financial institutions, addressing biodiversity risk is now a question of sound financial risk management. Leading banks, investors and insurers are setting biodiversity targets, as a first step to reduce their risk exposure. ASN Bank has declared they will have a net positive effect on biodiversity by 2030. Storebrand aims to have an investment portfolio that does not contribute to deforestation by 2025.

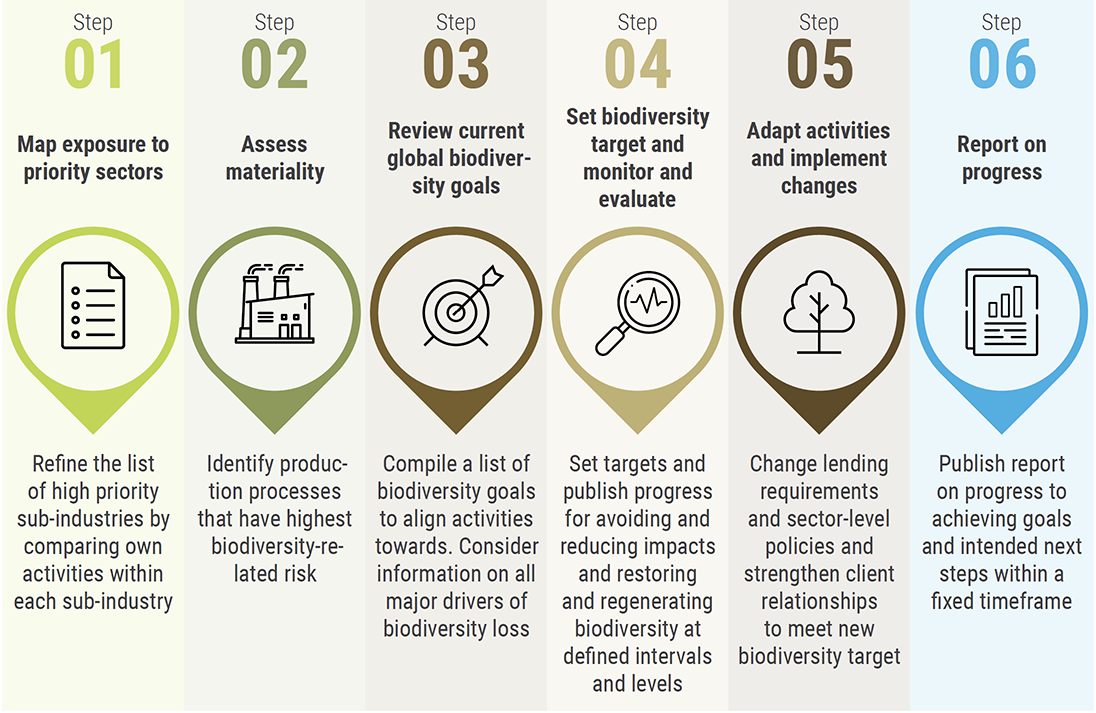

To join this group of leaders, other financial institutions can follow these six simple steps to adopt biodiversity targets of their own:

Step 1: Map exposure to 9 priority sub-industries

Our recent report recommends that financial institutions start with mapping their activities against the nine sub-industries that have the highest biodiversity risk (in alphabetical order):

- Agricultural Products

- Apparel, Accessories & Luxury Goods

- Brewers

- Distribution

- Electric Utilities

- Independent Power Producers & Energy Traders

- Mining

- Oil & Gas Exploration & Production

- Oil & Gas Storage & Transportation

What exposure does the institution have to each of these sub-industries? We recommend that each financial institution initially focuses on the five sub-industries they are most exposed to.

Step 2: Assess biodiversity risk across the top 5 sub-industries

The next step is to identify the level and type of biodiversity risk for each of the five sub-industries. This requires the financial institution to first drill down into the production processes for each sub-industry.

Then, use the online tool ENCORE, developed by the Natural Capital Finance Alliance (NCFA) and UN Environment Programme World Conservation Monitoring Centre (UNEP-WCMC), to identify which specific production processes have high or very high material impacts or dependencies on biodiversity. The Dutch Central Bank used ENCORE in this way to assess the ways in which the Dutch financial sector is indirectly dependent on services from nature.

How does ENCORE work? Picture a bank with significant lending to agricultural producers particularly focused on beef production. The ENCORE tool shows that large-scale livestock production is exposed to high or very high biodiversity risk in two ways. First, fibres and other materials from plants, algae and animals provide animal feed and fertiliser for feed. Without those, the company would struggle to continue production. Second, high soil quality (which relies on biodiversity) is critical; degraded soil would reduce the availability of animal feed, and again, production would suffer. As well as evaluating these types of dependencies, ENCORE can also help users identify the impacts the production processes have on biodiversity.

With these insights from ENCORE, the bank can understand exactly how their lending to agricultural producers exposes them to biodiversity risk. The bank would repeat this process for each of the five sub-industries identified to get a complete picture of their biodiversity-related risks.

Step 3: Review current global biodiversity goals

The financial institution now compiles a list of relevant biodiversity goals. Popular options to consider include:

- No net loss of biodiversity

- Net biodiversity gain

- Zero deforestation

- Net zero deforestation

The gold standard is aligning company biodiversity targets with national targets and priorities, as these can support global biodiversity goals.

The financial institution then decides on the scope of the target: Will they focus on ecosystems, species, ecosystem services or all aspects of biodiversity? Which financial activities will be covered by the target? Will the goal apply across individual project lending, funds, assets, insurance premiums, or all activities?

Step 4: Set targets and establish a monitoring and evaluation framework

Step 5: Implement changes in financing activities

Targets are only a tool to guide changes in practices and processes. To meet their targets, financial institutions must incorporate biodiversity into their own corporate strategies. Each financial institution will implement different changes, but three key action areas stand out as priorities:

- Establish sector-level policies on biodiversity. For example, in 2019 BNP Paribas Asset Management committed to integrate natural capital into its ESG scoring system for companies in the food retail sector.

- Strengthen client engagement procedures to ensure standards and criteria to safeguard biodiversity are being met. Engagement with investee companies on deforestation is a central aspect of Storebrand’s zero deforestation policy.

- Collaborate under initiatives working to advance biodiversity goals, including the Task-Force on Nature-related Financial Disclosures (TNFD). A substantial number of financial institutions have signed up to participate in an Informal Working Group that will bring together a TNFD by early 2021. A public announcement of the working group members will be made tomorrow.

Step 6: Report on progress and next steps

When reporting on progress, financial institutions can use frameworks such as the Global Reporting Initiative’s biodiversity reporting document. In their progress report, financial institutions should include a five-year plan outlining the next steps to put nature protection at the centre of their business strategy.

For more details on how to set biodiversity targets, read the NCFA and UNEP-WCMC’s recent report ‘Beyond ‘Business as Usual’: Biodiversity Targets and Finance’

Keep an eye out for the ENCORE biodiversity module

The NCFA and UNEP-WCMC are working on an update to ENCORE that will simplify biodiversity target setting further by enabling financial institutions to assess the current exposure of their portfolios to biodiversity risk and alignment of their portfolios with global biodiversity goals.

Follow us on social media to stay up to date with the latest: @NatCapFinance @globalcanopy @UNEP_FI @unepwcmc.

Find out more

The NCFA is a finance sector-led initiative catalysed by the UN Environment Finance Initiative (UNEP FI) and Global Canopy.

ENCORE is developed by NCFA in partnership with the UN Environment Programme World Conservation Monitoring Centre (UNEP-WCMC). The tool is free to use.