About

The V20 Sustainable Insurance Facility is a project pipeline facility created to support the development and availability of climate-smart insurance solutions for micro, small, and medium-sized enterprises (MSMEs) in climate-vulnerable nations.

The facility and was formed by the United Nations under the Principles of Sustainable Insurance in collaboration with the Munich Climate Insurance Initiative in response to the needs identified by the V20 Secretariat.

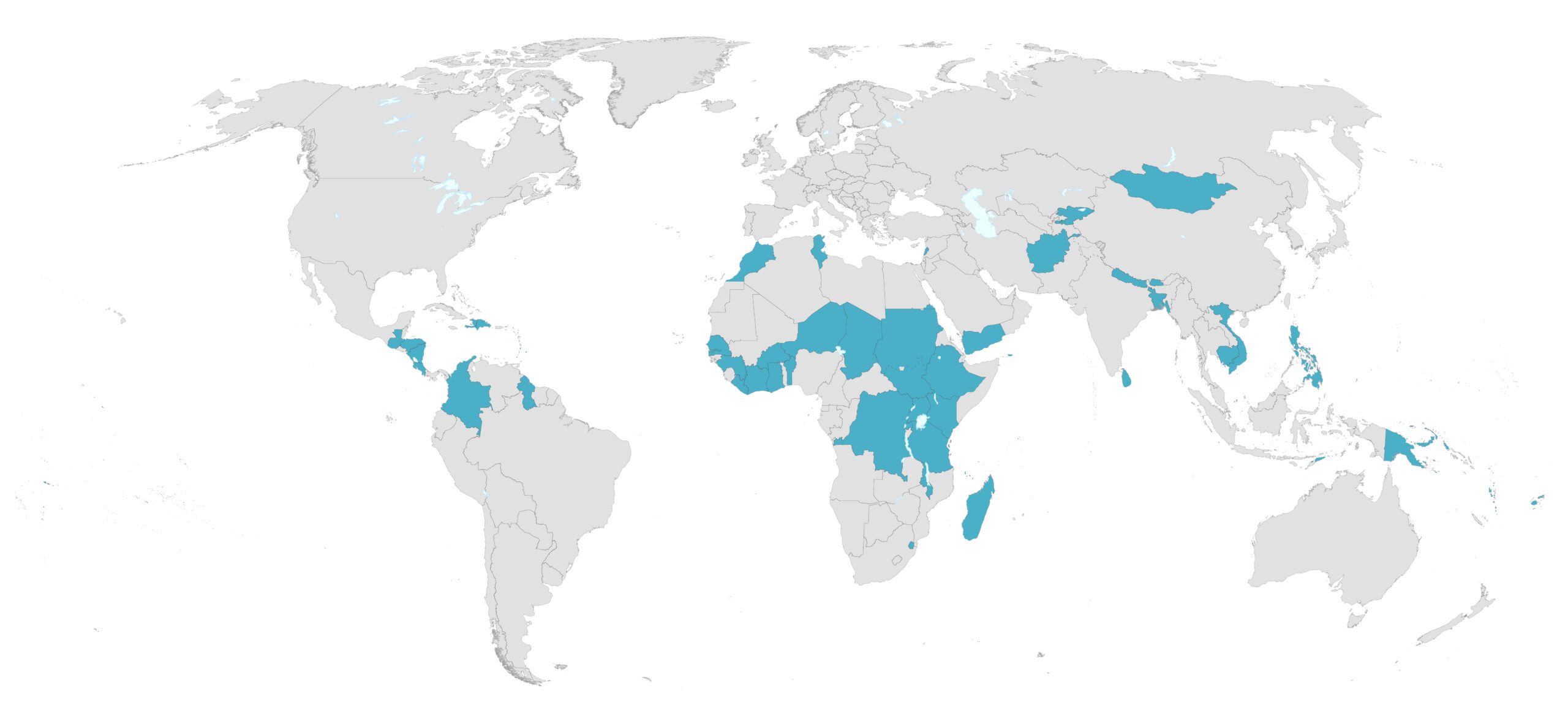

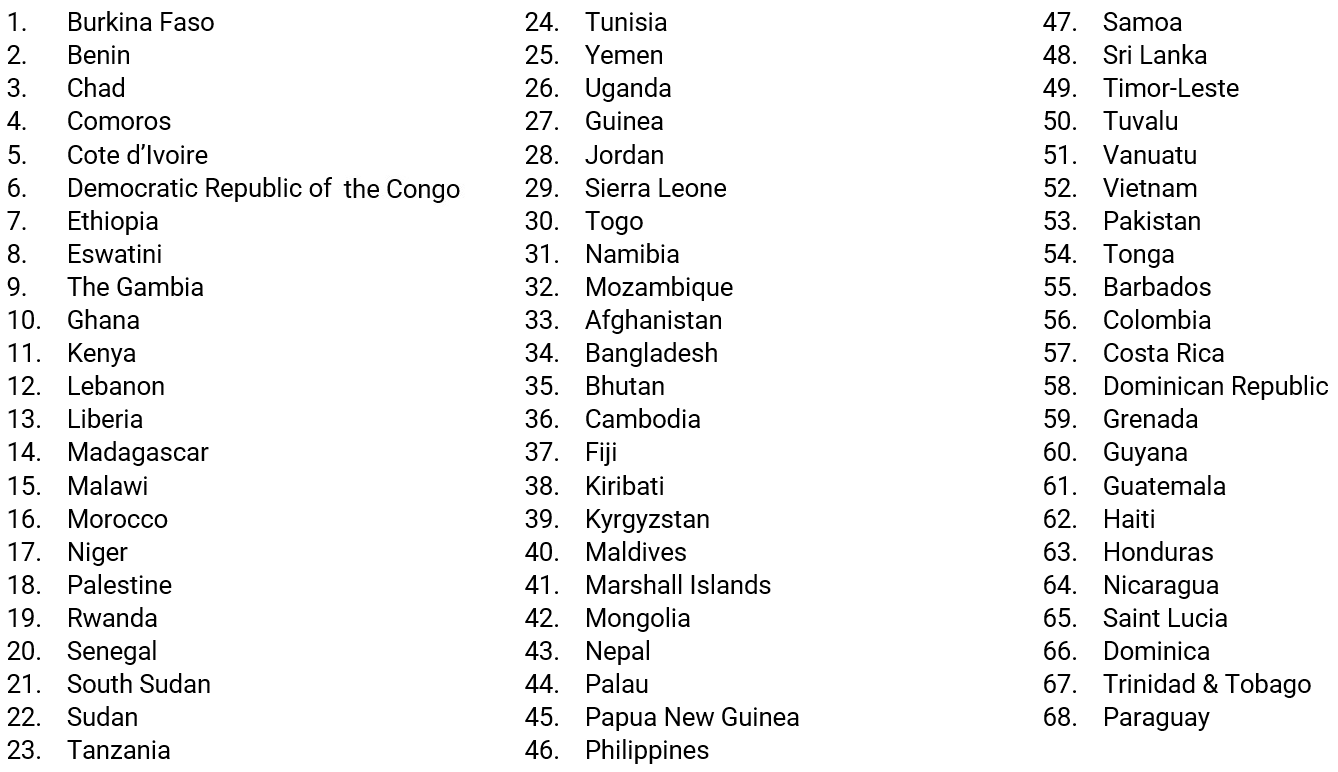

V20 Nations

The V20 Secretariat includes members in multiple regions around the world, including Latin America and the Caribbean, Africa and the Middle East, and the Asia Pacific.

The V20 SIF works in close partnership with V20 Finance Ministers to assess the needs of beneficiaries, provide expert market insight to prospective partners, and facilitate demand aggregation to hedge risks in product development and launch to market.

The Insurance Last Mile

The V20 Sustainable Insurance Facility recognises the “Insurance Last Mile” as the major hurdle for MSMEs accessing adequate cover.

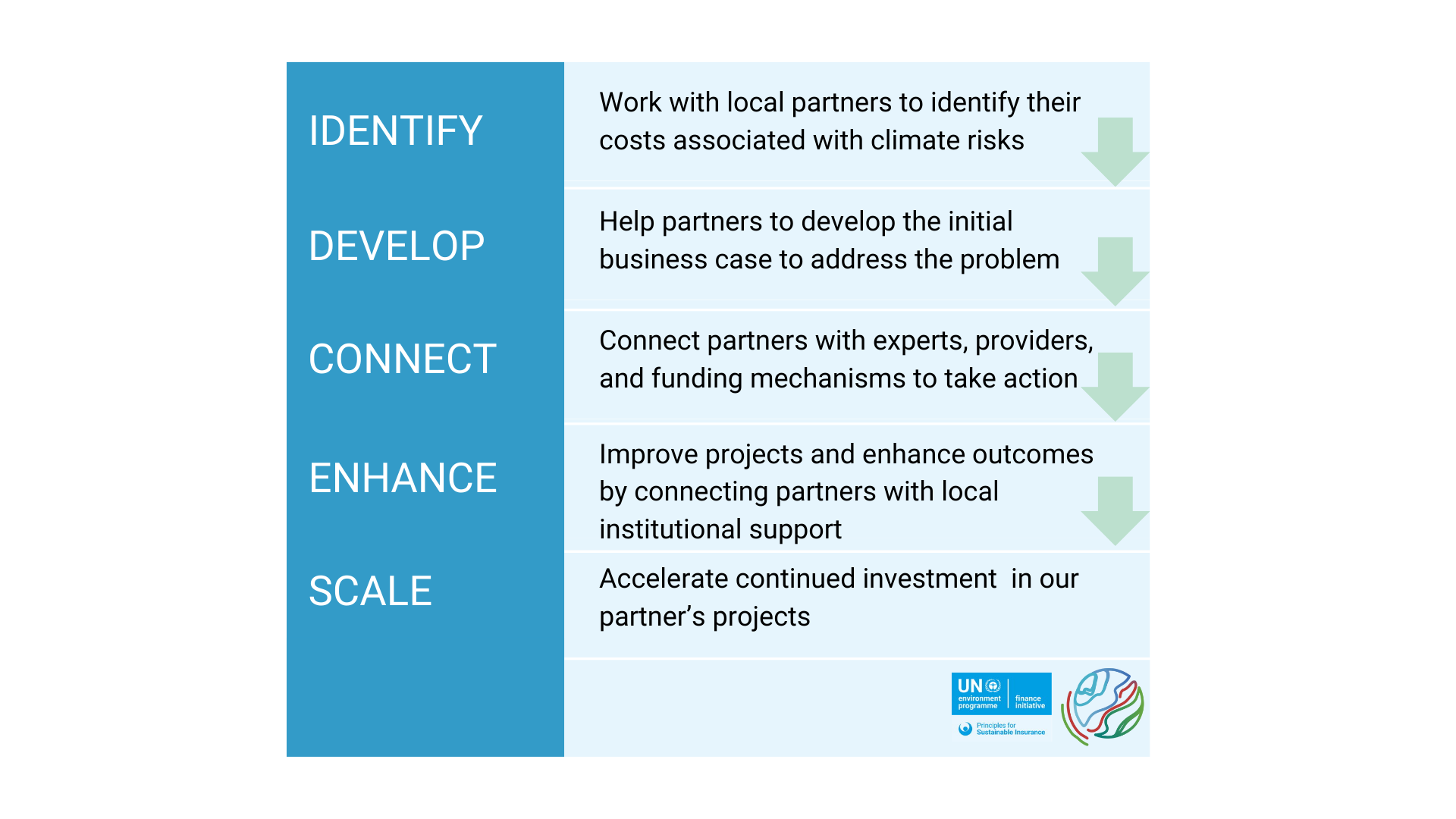

Our approach for overcoming the challenge:

In V20 nations, micro, small, and medium-sized enterprises account for 70% of employment and 40% of total GDP. However, the nature of their industries coupled with their lack of financial safety net leaves them particularly vulnerable to climate instability and ecological disasters.

Climate smart insurance solutions are a potent risk financing mechanism for mitigating climate risks. However, in V20 nations, micro, small, and medium-sized enterprises are vastly under-protected with less than 15% of these businesses having adequate cover. V20 Sustainable Insurance Facility is the only dedicated agency working in these V20 markets to develop a pipeline of projects that would enhance access to climate risk insurance solutions.

V20 SIF works with entities that have pre-existing at scale relationships with MSMEs, such as banks, micro finance institutions, state agencies, digital platforms, and others, to define climate risks and develop solutions to overcome the insurance last mile.

V20 SIF helps facilitate the scaling of climate-smart insurance solutions by connecting demand aggregators for building products tailored to climate-related risks. Furthermore, as an entity of the United Nations, we advocate for public-private partnerships, targeting policy makers and private sector leaders, with the aim to provide a safety net for critical businesses in V20 economies.

How we work

In working with banks, insurers, and other demand aggregators, V20 SIF intends to strengthen the climate resilience of climate vulnerable industries, their broader supply chains, and ultimately, the entire economies of V20 Nations.

The Team

Diana Chepngeno

Regional Coordinator for Africa & Middle East

Brandon Mathews

Global Coordinator for the V20 Sustainable Insurance Facility

Reace Novello

Communications Officer

Manoj Pandey

Regional Coordinator for Asia-Pacific

Gabriel Perez

Regional Coordinator for Latin America & the Caribbean

Contact us: