This list of questions aims to cover topics of most interest regarding the Third Progress Report of the UN-Convened Net-Zero Asset Owner Alliance. In case you did not find answers to your questions here, please reach out to Oliver Wagg or Teodora Cakarmis.

Why does the UN-Convened Net-Zero Asset Owner Alliance (the Alliance) publish a progress report? What is its purpose and what does it cover?

The Alliance’s minimum membership requirements are outlined in its Commitment document; by signing it, members pledge to: 1) transition their investment portfolios to net-zero greenhouse gas (GHG) emissions by 2050, 2) establish intermediate targets every five years, and 3) report on progress annually. By submitting their data in the Alliance’s reporting cycle, the members meet the third requirement. The progress report then serves to communicate transparently on members’ aggregated data and to open discussions on the leadership but also challenges of net-zero investors. The data presented in the report covers the targets members have set, the implementation of the Alliance’s positions, and the advances members have made while working in the Working Tracks of the Alliance.

As of 16 October 2023, the Alliance has 86 members, have they all set intermediate climate targets?

Members are required to publish and inform the Alliance Secretariat of their individual intermediate targets within 12 months of joining the Alliance.

Based on their date of joining, 71 members should have published their targets and reported on them by the end of the Alliance’s reporting cycle in May 2023. However, the Alliance’s progress report covers 69 members because one member has published its targets without reporting on them, while another has not yet published its targets. These two members were approached by the Alliance’s Secretariat, according to the procedures of the Accountability Mechanism, and all efforts will be made for these members to meet the minimum requirements in the following six months.

An additional three members (for a total of 73 members) have published their targets between May and September, in line with their schedules, but will only be expected to report on their targets in the next year’s reporting cycle (see table 2 for more details).

Why has the figure on Alliance members’ combined assets under management (AuM) changed?

So far, the Alliance has reported on its members’ combined AuM based on the numbers that asset owners submitted on the day of joining the Alliance. However, given that institutions’ AuM may vary, the Alliance has now updated its methodology to report on members most recent AuM numbers, submitted in the current (2023) reporting cycle.

The reduction of the combined AuM to US$ 9.5 trillion in 2022 mirrors the contraction of the global economy caused by macroeconomic impacts of the COVID-19 pandemic and the war in Ukraine. Further possible factors are discussed on page 17 of the report.

How does intermediate target-setting work in the Alliance, what is the reporting based on?

Methodologies for members to set portfolio-level targets were established based on the Intergovernmental Panel on Climate Change 1.5°C scenarios with no- or limited-overshoot and the Paris Agreement schedule (Art. 4.6c) for intermediate target-setting. These methodologies are compiled in the Alliance’s Target-Setting Protocol (protocol), which is updated every year to render the methodologies more robust and sophisticated.

Based on the Alliance’s protocol, a standardised reporting template was developed, which members use to report on their targets, but also on their absolute financed GHG emissions, and their implementation of the Alliance’s positions.

According to the Alliance’s protocol, what kind of intermediate climate targets are members expected to set?

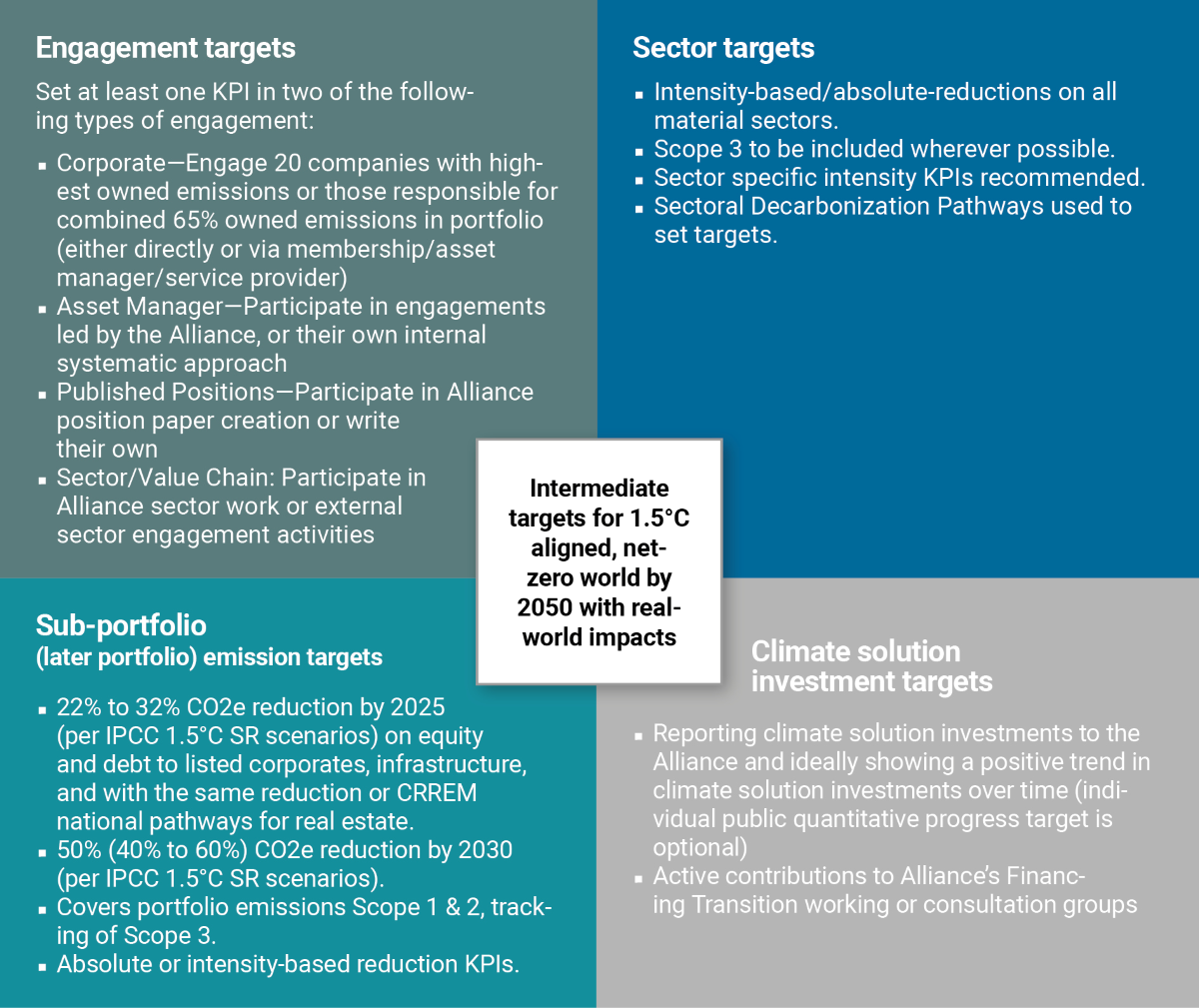

To comply with the Alliance’s protocol, members must set a target on three out of four of the following target types: sub-portfolio, sector, engagement, and investing in climate solutions. Setting an Engagement target is mandatory for all members, so that outcomes in the real economy are prioritised. The expected ambition levels and KPIs for the four target types are covered in the figure below.

Do members’ targets from the 2023 reporting cycle match the ambition set out in the Alliance’s Target-Setting Protocol?

On the whole, the 69 Alliance members reporting on their targets in the 2023 cycle exceed the requirements under the protocol in that they have set a total of 215 targets (whereas a minimum of three targets per member is required). Thus, eight members have set targets in all four target types.

Moreover, members have, on average, met the protocol ambition for each of the four target types. More granular data shows the following:

- Sup-portfolio targets: 67 members with $8 trillion chose this target type. These targets cover corporate debt, listed equity, and directly-held real estate—these asset classes make up $3.4 trillion. On average, the decarbonisation levels targeted by members fall within the protocol ranges of 22–32 per cent for 2025 and 40–60 per cent for 2030 (see Chapter 3 for more details).

- Sector targets: 9 members chose this target type, which is the same as last year. However, members who had previously set sector targets have increased their ambition levels, in particular for the oil and gas sector (see Chapter 3 for more details).

- Engagement targets: As required by the protocol, all 69 members have set targets on engagement. Moreover, members selected a total of 238 engagement KPIs for target-setting (an average of slightly more than three selected KPIs per member), exceeding the requirements of choosing two engagement KPIs per member. (see Chapter 4 for more details).

- Climate solution investment targets: 68 members chose this target type and the total amount of AuM invested in climate solutions reached $380.6 billion in 2023, up from 35 members with 222 billion invested last year (see Chapter 5 for more details).

What does the data on members’ absolute financed greenhouse gas (GHG) emissions tell us?

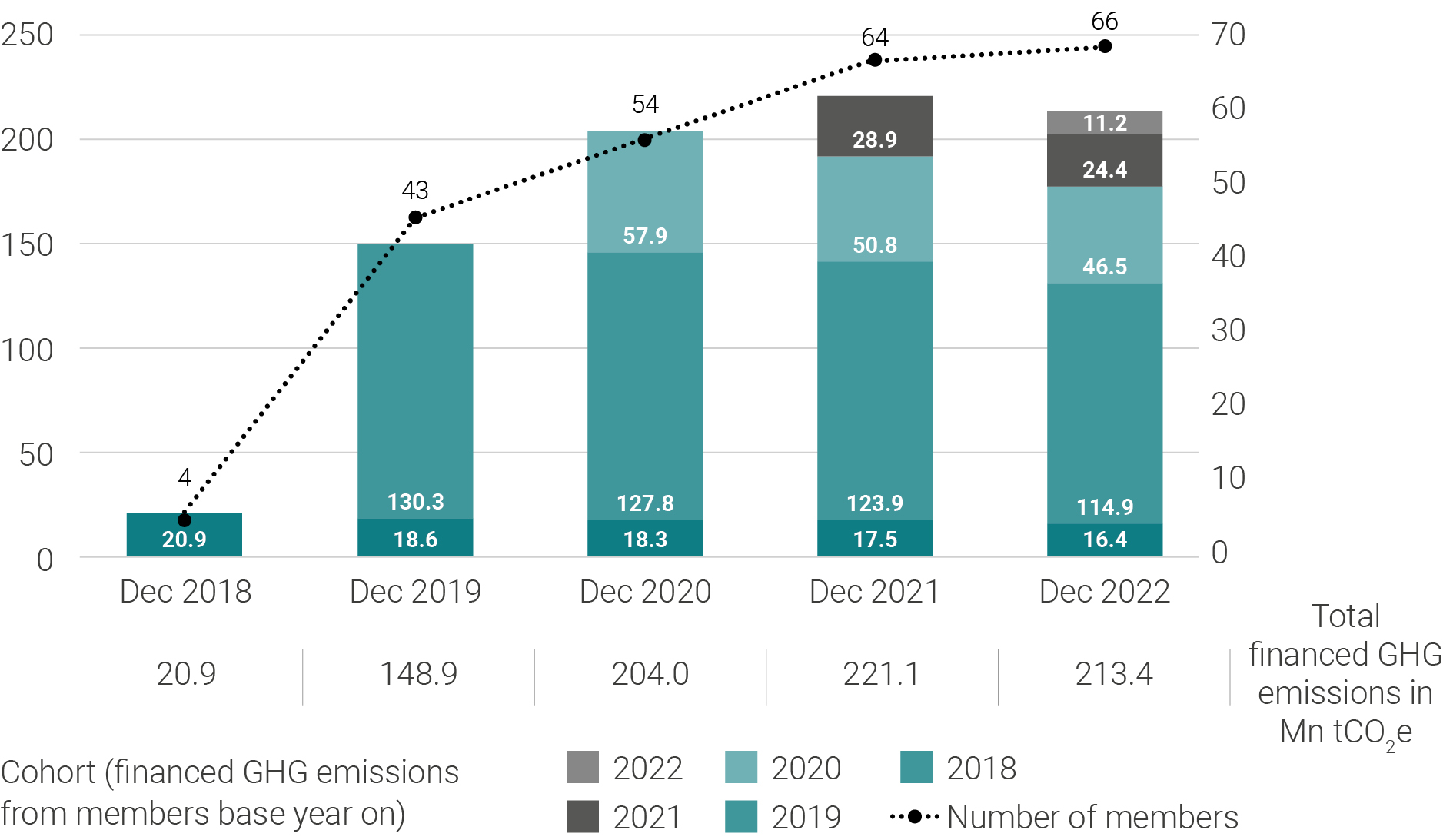

In 2023, for the first time ever, the Alliance has been able to secure reliable data to report on members’ combined absolute financed GHG emissions.1 The figure reveals the aggregated financed GHG emissions of all members that set their targets and reported emission data. With the Alliance’s rapid membership growth (shown as the black dotted line), the total of the Alliance’s absolute financed GHG emissions had increased between 2019 and 2021, when it reached 221.1 million tons of carbon dioxide equivalent (tCO2e). However, despite further growth in membership since 2021, the absolute financed GHG emissions decreased in 2022 to a total of 213.4 million tCO2e.

In the figure, different colours are used to delineate different member cohorts (grouped based on members’ first reporting year). What the data shows is a marked downward trend for each cohort. The largest cohort, made up of members that set their targets in 2019, reduced their financed GHG emissions from 130.3 million tCO2e in 2019 to 114.9 million tCO2e in 2022. Similar reduction trends can be observed for the 2018, 2020 and 2021 cohorts.

It is important to note that in addition to members’ climate action, reductions in absolute financed emissions have multiple other drivers, such real-world emissions reductions, allocation changes, or divestment. Please see Chapter 2 for a longer discussion on this topic.

Looking beyond target-setting, what does the 2023 progress data reveal?

Members are required to report on their implementation of the Alliance’s positions 12 months after joining or after the publication of a position. This year, data on members’ alignment with the Position on Thermal Coal (published in 2020) is included in the report and shows that 97 percent of members setting intermediate target have a coal position, 82 percent of which are aligned with the Alliance’s position (see Chapter 3 for more details).

Will there be changes to reporting requirements in the future?

With the updates in the Alliance’s protocol, the reporting requirements will change in parallel. The same is true for the Alliance’s positions. In 2024, for example, members will be expected to report on their alignment with the Alliance’s Position on the Oil and Gas Sector.