Basis for the Target Setting Protocol Second Edition

Building on the first edition of the Target Setting Protocol, the Net-Zero Asset Owner Alliance has launched the more ambitious second edition (TSP2), aligned with the very latest IPCC pathways to keep global warming below 1.5oC. Developed by the Alliance’s MRV track, the Protocol underwent a public consultation to arrive at a document that guides Alliance members in setting science-based targets on their financed emissions, clearly communicating the Alliance’s role and approach to portfolio decarbonization (its benefits and limitations).

Based on the latest IPCC no/low overshoot pathways, absolute emissions reductions for the period 2020 to 2025 should range between 22% and 32%. Considering the newest findings, Günther Thallinger Board Member Allianz SE & Chair UN-convened Net-Zero Asset Owner Alliance said:

“This is not the time for complacency. It is certainly not the time to discuss whether 1.5 degrees must be achieved, and interim steps need to be defined. We—every company—needs to act powerfully, credibly and quickly and, not least, together to support governments to achieve a net-zero emissions world.”

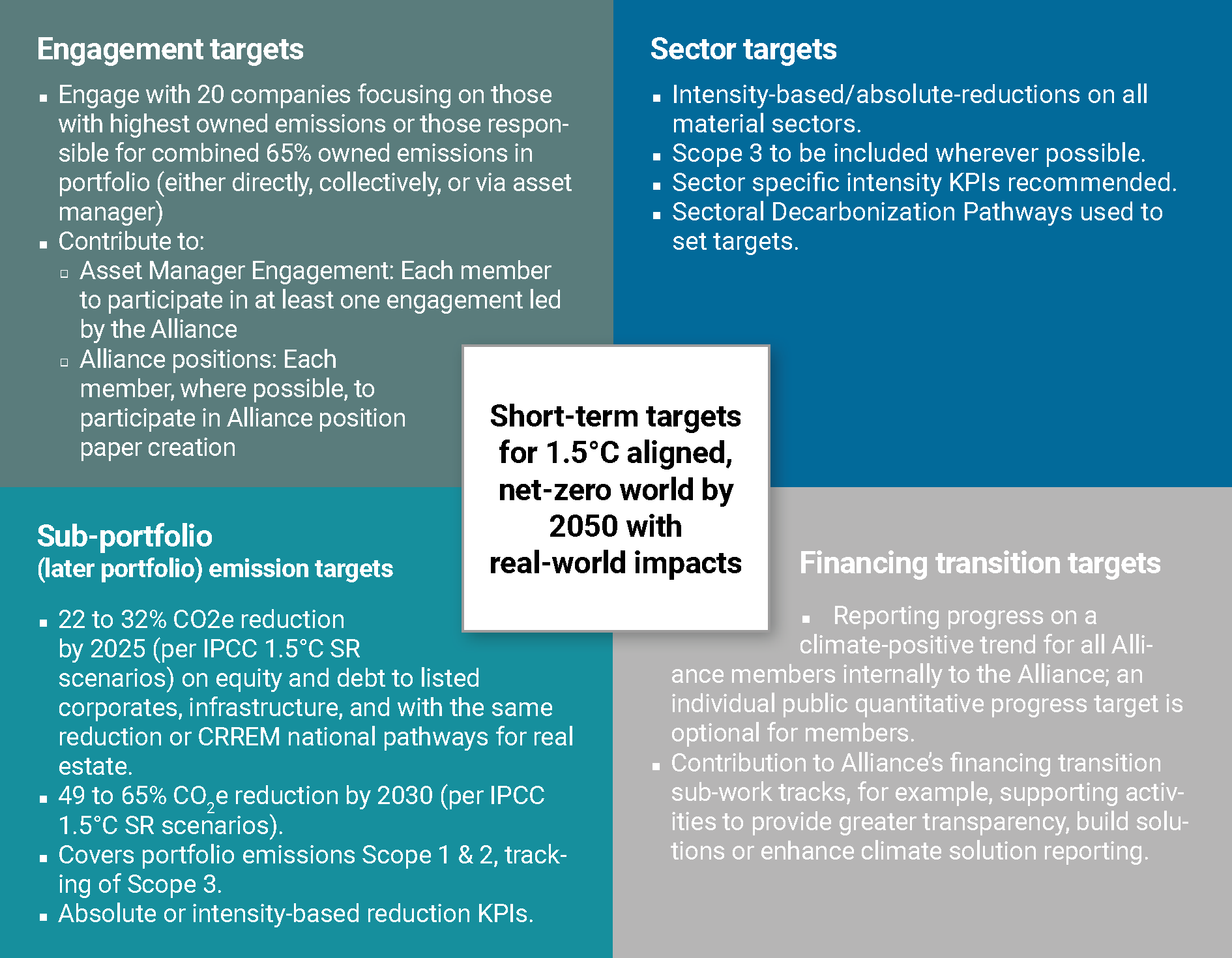

To respond to this challenge, the Alliance expects its members to set interim 2025 targets on 4 pillars –Sub-portfolio, Sector, Engagement, and Financing Transition.

Sub-portfolio targets

On top of the 2025 targets, the TSP2 introduces the outlook to 2030. The absolute CO2 emissions reduction range has been defined as 49% to 65%, compared to the base year 2020. The portfolio decarbonization targets have thus far been applied to listed equity, publicly traded corporate bonds, and real estate assets.

The Alliance members will now also be asked to set targets on infrastructure assets, such as energy, transportation, social infrastructure, and others. Initially, members will be expected to set a target for those direct investments into infrastructure where one of the following is true: i) member has an ownership share greater than 20%, ii) member has a seat on the board, or iii) the asset qualifies as carbon-intensive energy infrastructure.

Members will then phase in targets on all infrastructure assets by the end of 2025 (see table 1). Similarly, members are asked to measure and report the annual emissions of carbon-intensive energy infrastructure within their infrastructure portfolios by 2022, but will be asked to do so for all other infrastructure assets by 2025.

In addition, the Alliance is making significant steps towards incorporating sovereign debt as an asset class into the Protocol. For now, carbon accounting methodologies have been developed with the Partnership for Carbon Accounting Financials (PCAF) and a target-setting process for sovereign debt will be laid out in 2023.

Infrastructure reporting and target-setting timeline

Sector targets

Sector targets help link portfolio-level reductions to the carbon efficiency requirements of a given sector and therefore, real-world outcomes. These targets can also be useful for members to understand a company’s performance relative to its peers in the same sector and allow for informed capital re-allocation within or between sectors. Alliance members have committed to progressively implement sector targets beginning with their most material sectors from an owned-carbon emissions standpoint. By 2025, at least 70% of total owned emissions should be covered by sector targets.

The targets should be set in line with pathways, set out for priority sectors. The inaugural Protocol covered the 7 most high-emitting sectors, including Energy, Transport and Steel. However, the second edition now covers double the number of priority sectors (14), including Oil & Gas; Utilities, including coal; Transport: Civil aviation, Shipping, Road transport (11–17% of global emissions); Materials: Steel, Cement, and Aluminium; Agriculture, forestry, and fisheries; Chemicals; Construction and buildings; Water utilities; Textiles and leather. More granularly, sector targets for utilities and energy sectors should reflect the scientific consensus and members’ internal coal phase-out policies are expected to be in line with the Alliance’s Thermal Coal Position.

Engagement targets

The Alliance sees engagement as potentially the most important mechanism asset owners must contribute to a net-zero transformation. Therefore, although members can set three out of four targets, all members are required to set engagement targets.

Alliance members can approach engagement from a variety of angles: corporate; sector and value chain; and asset manager engagement. The desired outcome of any engagement type is alignment with 1.5°C no/low overshoot trajectories. To set targets for engagement, members are expected to:

- Focus on 20 companies with either the highest owned emissions or those responsible for combined 65% owned emissions in a member’s portfolio.

- Set up a structured engagement approach integrated with their selection, appointment, and monitoring activities of asset managers.

- Select two or more of the four forms of engagement contributions listed above and set their own outcome-based KPI from the common KPI framework (Annex).

The second version of the Protocol articulates key asks of asset managers, included on page 64. Moreover, Alliance members that rely on their asset managers for casting proxy votes should use the Alliance proxy voting guidance.

Financing transition targets

This portion of Alliance’s work and of the Protocol aims to enhance the supply side of investments in economic activities that contribute substantially to climate mitigation/adaptation – climate solution investments. The aim is also to support the growth of such investments within the members’ portfolios.

In this area, an individual public quantitative progress target is optional for members. However, independently from whether members set a financing transition target, they must all report annually to the Alliance on climate solution investments tracking.

Policy engagement

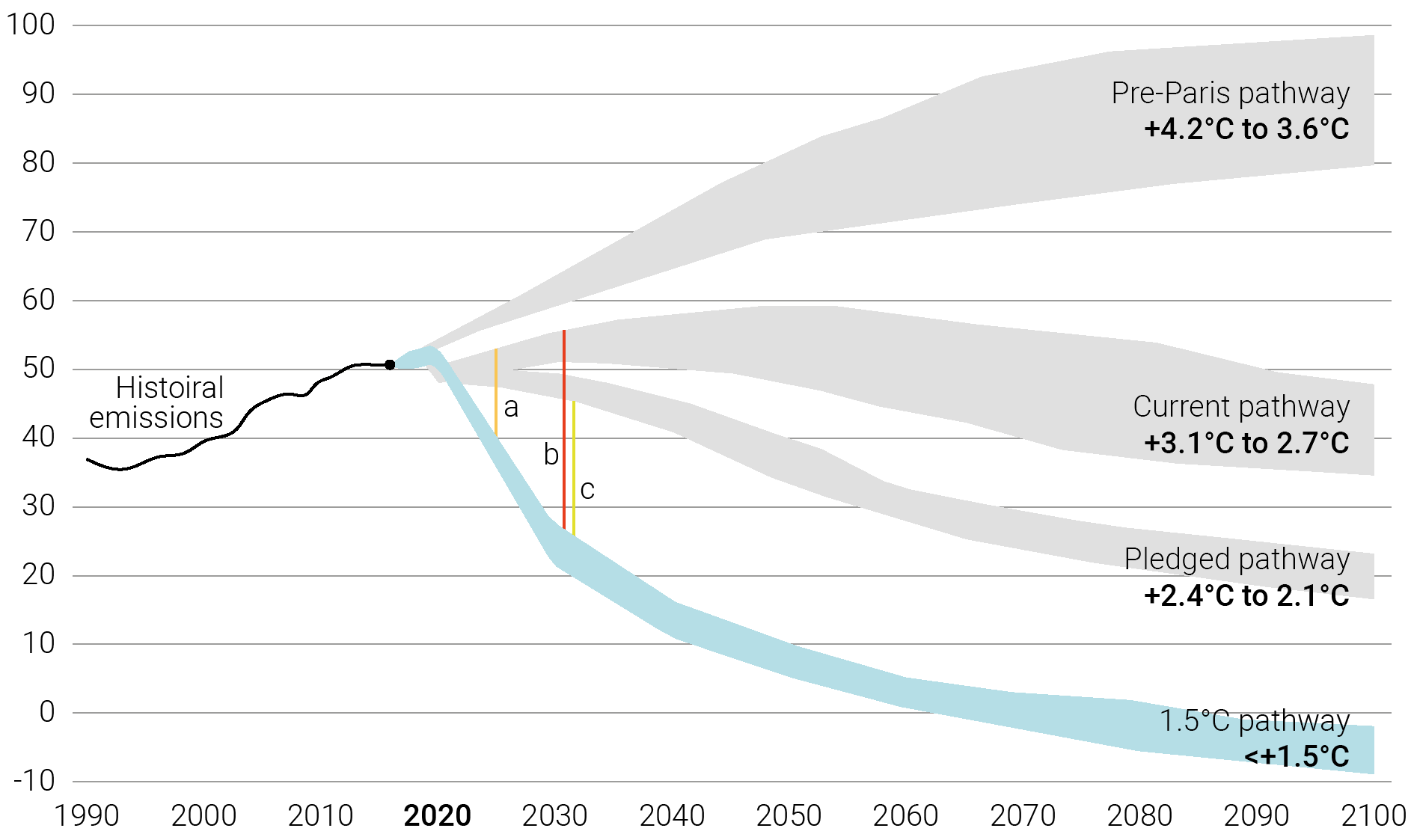

For the world to be on a veritable pathway to limiting global warming to 1.5oC, the Alliance cannot act alone. Unfortunately, the gap between the Alliance’s progress towards net zero emissions and that of the real economy is widening (diagram 2).

Eventually, this decoupling will force Alliance members to divest from entire sectors to bring their portfolios in line with set targets; this outcome would be highly harmful to the speed of the planetary transition to net zero since the real economy would be left behind.

Illustration of scientific and real economy emissions pathway divergence

Therefore, there is a clear need for governments and policymakers as well as corporates to facilitate the net-zero transition by moving in line with science. The Alliance recognizes this, which is why although asset owners are not expected to set targets on policy engagement since the outcomes do not depend on them (alone), members are expected to contribute to the policy work track on three focus areas:

- Alignment of governments’ 2030 emissions reductions targets with net-zero goals and pathways by 2050;

- Promoting sector policies that accelerate the energy transition and decarbonization; and

- Promoting mandatory climate reporting and business transition plans from investee companies

This Protocol is further reinforced by a robust reporting mechanism. Alliance members submit and publish targets within 12 months of joining (unless the end of the reporting cycle is within three months of joining, then members should submit and publish within a maximum of 15 months). Alliance members also report on progress on an annual basis, both internally and publicly; last year, the Alliance published its first Progress Report. Finally, this Protocol should be read and used as a living document, based on the best currently available data and methodologies, and therefore bound to change and evolve as newer methods are developed.

For media inquiries, please contact Oliver Wagg. For inquiries on the content of the Protocol, please contact Jesica Andrews.