10 October 2022 – UNEP FI is pleased to launch the Impact Protocol for Banks, along with the latest Module of Version 3 of the Portfolio Impact Analysis Tool for Banks, marking the consolidation of a full toolkit for impact management for banks.

In 2017 UNEP FI’s Principles for Positive Impact Finance put forward a new, holistic, approach to impact management by private financial institutions, involving the systematic consideration of both positive and negative impacts across the three pillars of sustainable development (environmental, social, socio-economic).

In 2019, UNEP FI released the Principles for Responsible Banking (PRB), which requires signatory banks to align their core strategy, decision-making, lending and investment with the Sustainable Development Goals, and international agreements such as the Paris Climate Agreement. To achieve this, Principle 2 requires banks to perform an impact analysis of their portfolios, to identify their most significant impact areas and to set impact targets and action plans accordingly, so as to manage their positive and negative impacts.

The Impact Protocol provides a step-by-step overview of how to analyse and manage bank portfolio impacts as per UNEP FI’s holistic impact approach, and in conformity with the requirements of the Principles for Responsible Banking.

Find out more about the Protocol here.

Portfolio Impact Analysis Tool: New module

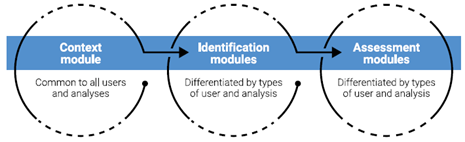

UNEP FI’s Impact Analysis Tools are the operationalisation of the holistic impact approach and methodology. As of 2022, the Tools are gradually transitioning to a ‘modular’ format, where the main components of impact analysis are contained within distinct modules. The new modular format allows more flexibility to accommodate for a variety of types of user.

The transition is now almost complete for the Bank Portfolio Tool; following the release of the Context and Identification Modules in July, the first Assessment Module, for Institutional Banking portfolios, has now been released. The Assessment Module enable users to: measure and assess their current practice and impact performance, with a view to determining targets and action plans accordingly. For PRB signatories, this will support efforts to comply with requirements under Principle 2 on Impact Analysis and Target-setting.

A second Assessment Module, for Consumer Banking portfolios, will be released in November, thus completing the collection.

Find out more about the Tool here.