The Impact Protocol provides a step-by-step overview of how to analyse and manage bank portfolio impacts as per UNEP FI’s holistic impact approach and in conformity with the requirements of the Principles for Responsible Banking.

- Download the Impact Protocol here

In 2017, UNEP FI’s Principles for Positive Impact Finance put forward a new, holistic, approach to impact management by private financial institutions, involving the systematic consideration of both positive and negative impacts across the three pillars of sustainable development (environmental, social and socio-economic).

In 2019, UNEP FI released the Principles for Responsible Banking (PRB), which requires signatory banks to align their core strategy, decision-making, lending and investment with the UN Sustainable Development Goals, and international agreements such as the Paris Climate Agreement. To achieve this, Principle 2 requires banks to perform an impact analysis of their portfolios to identify their most significant impact areas and set impact targets and action plans accordingly, so as to manage their positive and negative impacts.

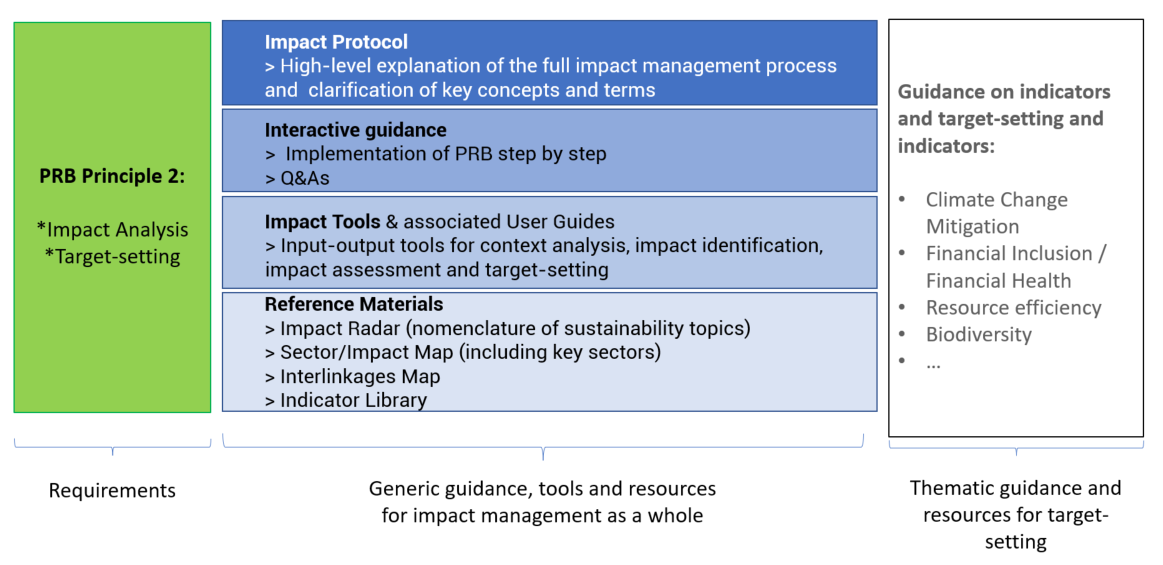

As illustrated below, the Protocol is complemented by a number of further resources, which together form a Toolkit for Impact Management. The Protocol provides a high-level overview of the impact management process as a whole, whereas the Interactive Guidance, the Tools and the Thematic Target-Setting Guidance can be used to operationalise the methodology. The relevant guidance, resources and tools are referenced throughout the Protocol.

UNEP FI Impact Management Toolkit for Banks:

Additional Resources

- Watch the webinar Introduction to the UNEP FI Toolkit for Impact Management & PRB Principle 2 here

- Download the slides from the webinar here

Copyright © United Nations Environment Programme, 2022

Disclaimer

It is our hope that the Impact Protocol will be a source of inspiration to many organisations as they develop their in-house impact management capabilities and/or any advisory services and products on impact management for third parties.

Any resources, tools, systems, products or services developed based on, referring to or otherwise using the Impact Protocol should acknowledge UNEP FI, however, the results, as well as any associated outcomes and decisions made based on such resources, are exclusively attributable to their developers and their own interpretation of the Impact Protocol. In no case may these be assumed to be aligned with UNEP FI’s views and methodologies and/or to have been validated, approved or otherwise certified by UNEP FI.

UNEP FI does not provide advisory services or certification for any resources, tools, systems, products or services developed based on, referring to or otherwising using the Impact Protocol.