The extent to which our global economy and financial system can flourish is fundamentally underpinned by the state of nature. However, our natural world continues to be rapidly and dangerously eroded. WWF and 90 civil society partners have urged central banks and financial supervisors to manage climate and biodiversity related financial risks as part of their primary mandates. Their call for action emphasizes how losses to nature and biodiversity pose material risks to the financial system and includes demands for consistent, market-wide risk identification and disclosure and also for promoting the enabling environment for new financial opportunities. UNEP FI’s Jessica Smith and Thomas Viegas from the Bank of England (Manager, Market Intelligence and Analysis) explain why they welcome this development and why nature has reached a tipping point where it’s no longer about ‘if’ we act to mitigate nature-risk but ‘how’ and ‘where’.

Private sector leadership showing the way

It is encouraging how much leadership we are seeing from the private sector on the topic of nature risk, for example from the Taskforce on Nature-related Financial Disclosures (TNFD) and amongst the Finance for Biodiversity Pledge signatories. This shows that the leading edge of the market, including both financial and corporate actors, see the business case emerging to act on nature.

Nearly 300 banks have joined together as signatories to the Principles for Responsible Banking (an initiative convened by UNEP FI) and these signatories are now setting biodiversity targets that complement their climate targets. And in China, thirty-six financial institutions announced the Joint Declaration of the Banking Sector to Support Biodiversity Conservation, aiming to build a partnership between biodiversity and financial services around the world and provide financial support in achieving eco-friendly, sustainable, green and inclusive development.

All of this activity is running ahead of a cohesive international policy framework to guide global policy. It builds from the draft of the not-yet-finalised Global Biodiversity Framework, expected to be delivered this December, as well as the Sustainable Development Goals on terrestrial and marine areas. As we countdown to CBD COP15.2, encouragingly, the financial sector is not standing still waiting for outcomes to begin to act.

Increased regulatory awareness is encouraging, with more needed to be done

This current corporate and financial institution activity is being observed and nudged along by many domestic governments and regulators. The commonly-cited blockages to action on nature loss are being addressed: more data is being collected, common metrics, standards and frameworks are being agreed, and national and international policies are synchronising. We are starting to see widespread regulatory responses, requiring mandatory disclosures in many jurisdictions which are expected to become a de facto universal operating requirement in the years ahead. As Elodie Feller, who leads UNEP FI’s new regulatory programme has noted: “Regulators don’t tend to do things out of the blue. In general, they look to market leaders to see what’s realistic before regulating market-wide”.

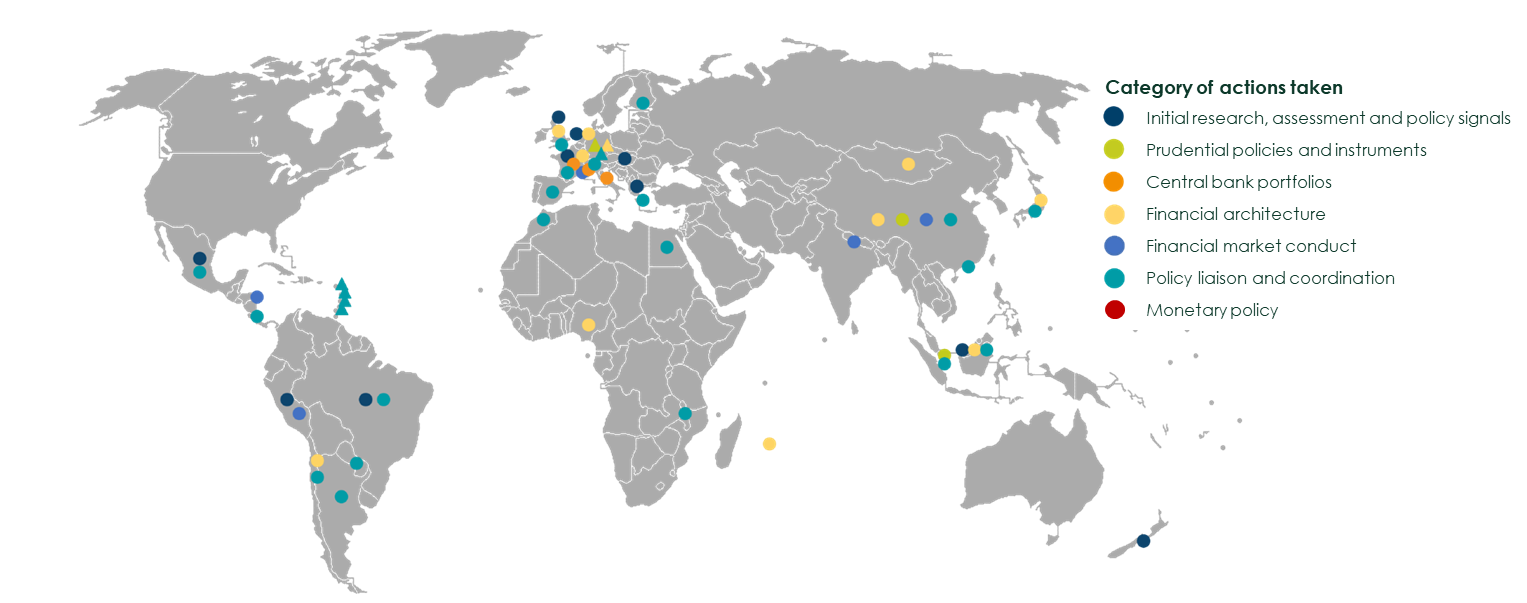

One pertinent challenge that requires urgent attention as highlighted by recent NGFS-INSPIRE work is that financial regulatory efforts are focused in geographies far removed from where important environmental assets are situated (demonstrated in the map below). Whilst large swathes of the Global South have intact biodiversity resources that must be preserved, action by financial regulators has so far emerged most rapidly from the Global North. For example, France’s commendable new Article 29 adds biodiversity-related risk disclosure to its climate disclosure laws. However, France is far down the list of the most biodiverse countries in the world.

Central banks and supervisors are starting to take action

Source: Adapted by Nick Robins, LSE from NGFS-INSPIRE (2021); presented to UNEP FI-NGFS-INSPIRE webinar Nature-related risks, central banks and financial system resilience – United Nations Environment – Finance Initiative (unepfi.org)

A few Global South countries are outliers here, notably in Latin America and south-east Asia, yet this remains an issue of environmental justice of great concern. Therefore, it is vital that central banks and supervisors who have made advances, including a number in Latin America, share financial governance best practices with all countries and regions, particularly those that are home to ‘globally systematically important natural assets’. Through capacity-building and knowledge sharing, central banks and institutions where greatest advancements have been made can support all countries to take advantage of the vast opportunities presented by green, nature-positive economies and their associated development benefits.

Similarly, the recently launched NGFS taskforce on nature-related risk, shows a commitment among central bankers and regulators on this issue – given that location matters, it will be vital that the group and its work covers those geographies where intact biodiversity is situated and where it is most at risk.

Inclusivity, focus and collaboration are needed

In a recent interview in ESG Investor, the head of UNEP FI Eric Usher noted that, “The relationship between the private sector leaning in voluntarily and the increase in regulation is a dance. One takes a step, signals the other and they take a step.”

We have now crossed the rubicon of awareness where central banks and financial regulators come to understand the importance of identifying nature risk and acting on nature loss. We now find ourselves in a place where central banks and financial regulators seek to deepen their understanding of the topic and to take action. Whether this is assessing the financial risks associated with nature loss – in part through scenario creation – exploring options for supervisory expectations in relation to nature – including disclosure – or helping to build the necessary financial architecture for mobilising investment for a nature-positive economy.

Only together will true action be possible, and so there must be a focus on efforts to extend actions to where there is greatest need. This means supporting other central banks and regulators where biodiversity is richest by sharing learnings, knowledge and expertise, and encouraging greater worldwide exchange between market leaders and regulators.

Reversing nature loss is an economy-wide issue, with economy-wide efforts needed. It is therefore critical that both public and private institutions work together, innovating to create mutually beneficial change that is aligned with what the world requires. This requires incorporating a wide range of views to ensure regulation and subsequent action is in the best interests of society including those who are most vulnerable.

Financial institutions from the private finance sector have shown leadership in engaging with the biodiversity challenge and making commitments. They can go further by requiring their clients to set science-based targets for nature and to disclose nature-related data and information – as they have done for climate.

It is only this combination of inclusivity, focus and collaboration between wider society and governments, central banks, regulators and individual financial institutions that can affect a global transition to a net-zero and nature-positive economy that benefits all people and planet.

Further resources

- Kedward et al 2022 Biodiversity loss and climate change interactions: financial stability implications for central banks and financial supervisor

- UNEP FI-NGFS-INSPIRE webinar recording Nature-related risks, central banks and financial system resilience – United Nations Environment – Finance Initiative (unepfi.org)

- NGFS occasional paper Biodiversity and financial stability: exploring the case for action – Grantham Research Institute on climate change and the environment (lse.ac.uk)

- TNFD Framework

- Viegas 2022

*All views are that of the authors and not those of any institutions or organisations