19 December 2023Banking, Climate Change, Impact Centre, Insurance, Investment, Nature, News, Policy, Pollution & Circular Economy, Social

POPULAR CONTENT

19 December 2023Banking, Climate Change, Impact Centre, Insurance, Investment, Nature, News, Policy, Pollution & Circular Economy, Social

18 November 2012News

19 December 2023Climate Change, News

A collection of events for UNEP Finance Initiative.

8 July 2019 Webinar

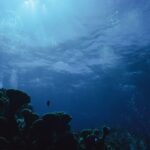

Join this Responsible Investor webinar to find out how investors are assessing ocean risks like acidification, biodiversity loss, and plastics pollution, and how leaders plan to align their portfolios with principles for a sustainable blue economy.

29 May 2019 Webinar

UNEP FI members from banking, insurance and investment are invited to this presentation of UNEP FI's paper on adaptation finance by the lead authors, Stacy Swann and Alan Miller of Climate Finance Advisors. The paper provides recommendations for financial institutions including integration in risk management systems and improved data & metrics.

21 May 2019 Webinar

28 March 2019 Webinar

Energy efficiency is one of the most concrete actions financial institutions can take to advance their sustainability performance and tap into the trillions of USD of energy inefficient assets. It is also increasingly on the radar of financial regulators as they consider an adjustment of capital adequacy requirements for certain types of energy efficient financial products. Real estate, which is the largest source of global stored wealth, is strongly affected by energy efficiency. With more than 230 billion USD of new investment every year, energy efficiency is almost as large a market as renewable energy.

28 February 2019 Webinar

UNEP FI has recently published its Positive Impact Real Estate Investment Framework, part of a suite of resources to address the SDG financing gap and shift financing practices so that environmental, social and economic impacts are fully considered, intended and measured in investment activities. This webinar will provide an overview of the Framework, and include presentations from practitioners using an impact-based approach in their investment strategies and acquisition and management.

21 February 2019 Webinar

The Natural Capital Finance Alliance, funded by the Swiss State Secretariat for Economic Affairs (SECO) and the MAVA Foundation, has come up with tools and insights to help practitioners identify material natural capital risks and opportunities within their portfolios and integrate these considerations into financial decision making. The webinar will provide an overview of the recently launched ENCORE tool (Exploring Natural Capital Opportunities, Risks and Exposure). It also marks the official online launch of the NCFA’s latest report produced by PwC, which applies the ENCORE tool to develop a natural capital assessment framework for enhanced portfolio risk management in banks.

22 January 2019 Webinar

17 December 2018 Webinar

The Technical Expert Group on Sustainable Finance set up by the Commission in July 2018 has launched a call for feedback on EU action to develop a unified EU-wide classification system – or taxonomy – for environmentally sustainable economic activities. This Webinar will provide background and guidance on the consultation process to support stakeholders and experts interested in contributing.