With calls to ‘build back better’ after the COVID-19 pandemic, how can insurance companies take a leadership role in transitioning ocean sectors towards sustainability?

The United Nations Environment Programme Finance Initiative (UNEP FI) assembled a star line-up for a webinar hosting a big-picture discussion on the key ocean-related sustainability trends that affect the insurance business.

In this article, we compile their expert insights with timely polling data from the webinar audience to offer a snapshot of the insurance industry’s triple role as risk managers, insurers and investors in financing a sustainable blue economy.

Ready to dive in? Here are the key takeaways from the webinar.

1. Ocean-related sustainability issues are increasingly relevant to the insurance industry

In UNEP FI’s recent webinar on the sustainable blue economy with insurance executives, it was evident that sustainability is top of mind and increasingly relevant for the industry.

Pointing to recent news including the oil spill off the coast of Mauritius, the large-scale explosion in the port of Beirut, and the public outcry over illegal fishing fleets, Dennis Fritsch, Programme Lead of the UNEP FI Sustainable Blue Economy Finance Initiative said, “one just has to look at recent headlines to see that mismanaged marine industries and economic activities with a negative impact on the ocean are receiving ever more coverage and climbing up the agenda of governments, financial institutions and society as a whole.”

With global growth in the latest IMF forecast projected at −4.4 per cent in 2020, followed by a “long, uneven recovery” in 2021, it is clear that ocean-linked industries will likely also be affected by the impact of COVID-19. Despite this, highlighted a recent report by The Economist; “the fundamentals driving progress towards sustainability remain strong: the need to combat climate change and to sustainably feed a growing population are not going away”. With many policymakers looking at how to instil new sustainability principles into economic recovery packages, this could be a key opportunity to ‘build back better’.

Sustainability is top of mind and increasingly relevant for the insurance industry, says Dennis Fritsch of the UNEP FI Sustainable Blue Economy Finance Initiative Share on XA recent survey of senior maritime leaders, the Global Maritime Issues Monitor 2020, showed increased demand for sustainability and highlighted new environmental regulation as likely to have a major impact on the maritime industry in the next 10 years.

With fundamental drivers remaining strong, the UNEP FI’s Principles for Sustainable Insurance (PSI) initiative recently launched the first global insurance industry guide to tackle a wide range of sustainability risks. The guide outlines eight areas comprising possible actions for insurers to manage ESG risks and two high-level, optional “heat maps” indicating the potential level of ESG risk across economic sectors and lines of insurance business.

2. Climate change presents a complex variety of risks

“The transition to a net-zero economy will entail risks and opportunities for insurers,” stated Butch Bacani, Programme Leader of the UNEP FI Principles for Sustainable Insurance initiative, reflecting on the growing number of countries committing to net zero carbon emissions by 2050.

“Climate change is clearly having an impact on the insurance industry,” stated Richard Turner, President of the International Union of Marine Insurance (IUMI). “Regardless of the type of insurance you conduct, there is no doubt that climate change is causing an increase in the frequency and severity of claim patterns that we are seeing. The financial impact has worsened by the fact that there is more wealth concentration, therefore claims are costlier and insurers are more exposed” added Turner.

“Climate change is clearly having an impact on the insurance industry” says Richard Turner of IUMI Share on XGlobal insurer AXA XL has been working on identifying ocean-related risks, especially in Small Island Developing States and emerging coastal economies. “We are evaluating the complex variety of risks arising from climate change, focusing on coastal storm damage” said Chip Cunliffe, Director of Sustainable Development at AXA XL. “For example, we know that by 2050 more than 800 million people will likely be affected by coastal flooding and storm surges from and extreme weather events.”

The types of assets that insurers are underwriting are also undergoing change, for instance in the marine insurance sector. “Asset change not only relates to production but also to the ships themselves, with the introduction of low-sulphur fuel and regulatory changes, for example,” suggested Turner. “We need to evaluate the sustainability of clients and sectors that we are protecting […] If there are no fish to catch, there is no trawler fleet and no insurance business.”

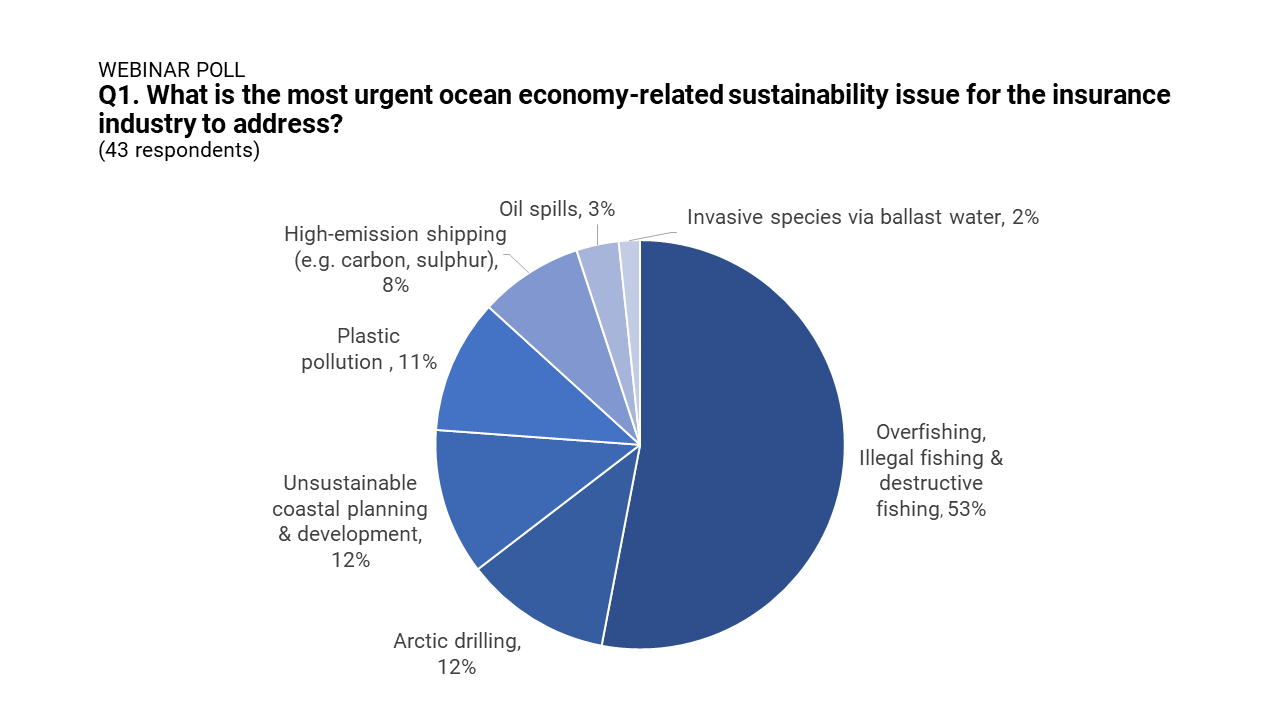

In fact, with almost 90% of fish stocks either fully exploited or overexploited, the long-term viability of the entire fishing industry is currently at risk. A survey of the webinar audience echoed this view, with overfishing, illegal and destructive fishing being seen as the most urgent ocean-related sustainability issue for the insurance industry to address.

In February 2019, the PSI, together with Oceana and leading insurers issued a checklist of warning signs for pirate fishing activity, as part of a global insurance industry effort to curb illegal fishing. The risk assessment guidelines were developed to help the insurance industry to better detect and deny insurance to vessels and companies caught or suspected of pirate fishing.

Another relevant study was launched in November 2019 by UN Environment Programme (UNEP), supported by the PSI: “the first global insurance industry study on managing the risks associated with plastic pollution, marine plastic litter and microplastics”. This report shows that plastic pollution risks can affect insurance and investment portfolios in the form of physical, transition, liability and reputational risks. These range from threats to human health to evolving liability claims connected to marine litter and plastic pollution should be closely monitored by insurers in coming years.

Our webinar poll showed overfishing/illegal fishing as a major concern for the insurance industry.

3. Demand for innovative insurance solutions is growing

In appreciation of the roles that insurers play, both as risk managers and risk carriers protecting society’s assets as well as institutional investors funding the economy, we asked participants to highlight where promising business opportunities lie for the insurance industry.

“Shipping, tourism, maritime activities and offshore renewables offer a great potential for innovation,” said Chip Cunliffe, Director of Sustainable Development, AXA XL.

“On the financial side, AXA has been reducing its investments in activities that have adverse effects on the environment, such as divesting from coal and oil sands. We’re also moving towards transition bonds and doubling the size of our biodiversity and climate impact fund to $300 Million. As we move towards COP26 and awareness of climate finance increases, demand from our clients will likely grow,” forecasted Cunliffe.

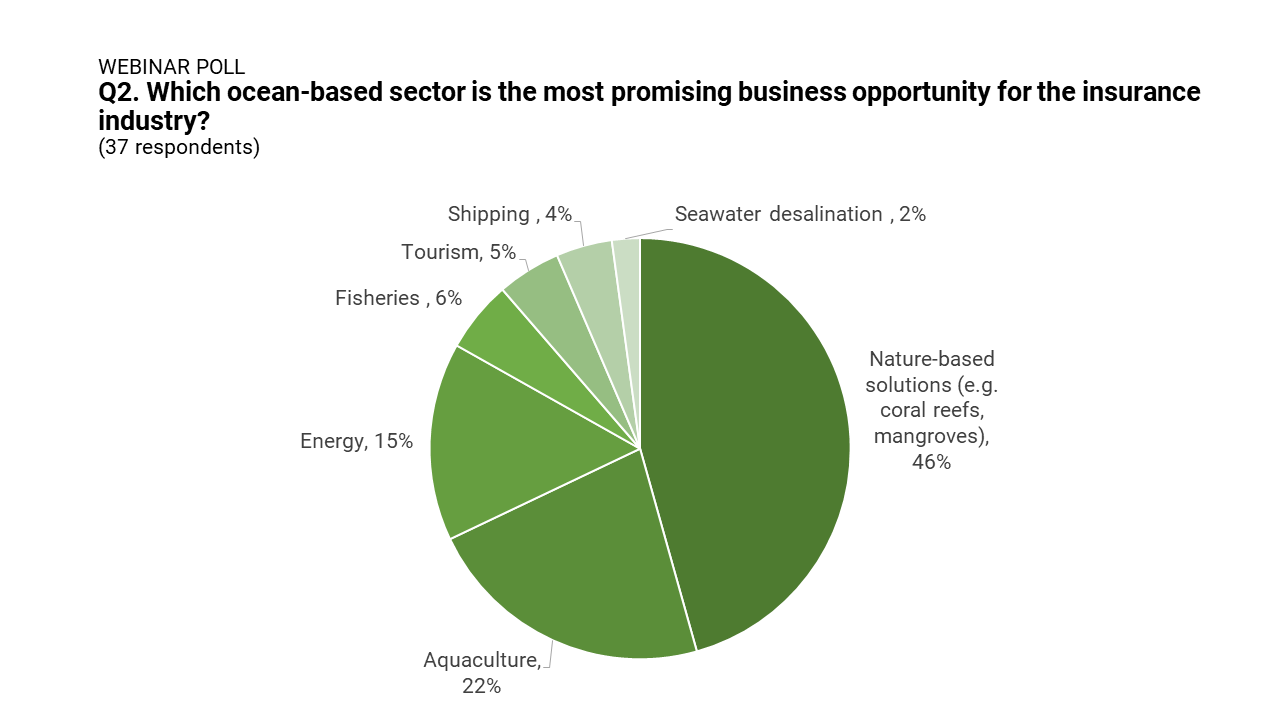

“Shipping, tourism, maritime activities and offshore renewables offer a great potential for innovation,” said Chip Cunliffe of AXA XL Share on XAn audience poll also pointed to nature-based solutions such as coral reefs and mangroves as one of the most promising ocean-based business opportunities for insurers, followed by aquaculture and the energy sector.

Nature-based solutions and aquaculture are two promising business opportunities for the insurance industry.

Nature-based solutions and aquaculture are two promising business opportunities for the insurance industry.

Globally, mangroves protect 15 million people from flooding and reduce flood damages by US$65 billion every year. Moreover, according to a recent study, mangroves can store four times the amount of carbon compared to terrestrial forests and at a 40-times faster rate.

AXA XL has been working with The Nature Conversancy to develop blue carbon resilience credits that value the combined carbon sequestration and coastal protection benefits of coastal wetlands. The insurer has also played a leading role to establish the Ocean Risk and Resilience Action Alliance (ORRAA) and explore nature-based solutions such as the restoration of mangroves as natural coastal defences.

Such nature-based solutions are relevant in the context of lowering risk exposure, as well as increasing resilience in times of unprecedented weather events and variability.

Another interesting growth area highlighted in our survey is aquaculture. As noted in a recent article on aquaculture by Gallagher Insurance, “fish farming projects are cropping up at an expeditious rate, consolidating the industry as one of the fastest-growing food sectors in the world”.

“Aquaculture is an extremely exciting sector and we are seeing a huge amount of interest in terms of its development,” said Daniel Fairweather, Director of Livestock, Aquaculture and Fisheries at Gallagher Insurance. “It is an effective way of producing protein for a growing population, without the impacts of traditional farming,” he added.

As the industry grows, sustainability needs to be at the forefront. The benefits of sustainable aquaculture are far-reaching and the World Bank estimates that sustainably managed fisheries would result in an additional 83 billion USD a year for the seafood sector.

“Aquaculture is an extremely exciting sector and we are seeing a huge amount of interest in terms of its development,” said Daniel Fairweather of Gallagher Insurance Share on XEnergy is another growing priority, particularly with the cost of wind energy decreasing combined with increased demand for renewables. “Sectors that align with the climate agenda, like offshore wind farms, will substantially grow in the future,” predicted Richard Turner of IUMI.

4. Insurance can act as an enabler of change

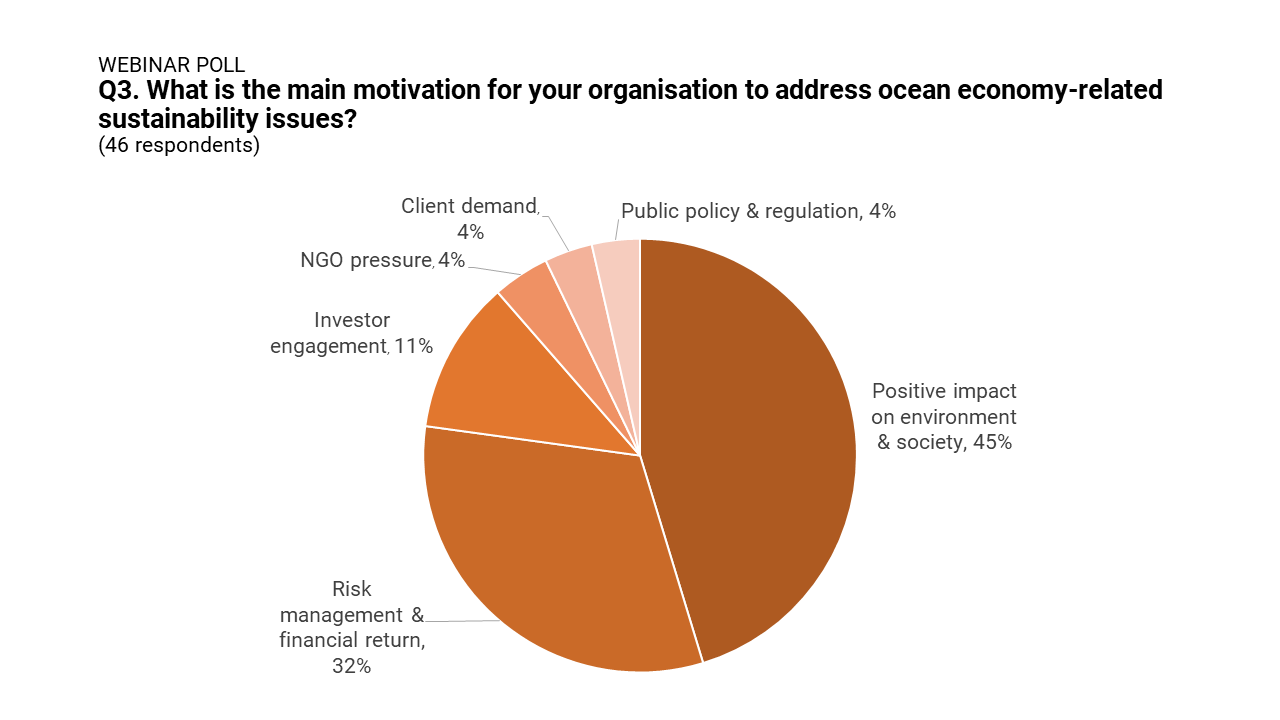

Together with the desire to have a positive impact on the environment and society, a third of the respondents of our straw poll said that risk management and financial return was their main motivation to address SDG 14-related sustainability issues.

This requires a multi-sectoral approach, and the insurance and reinsurance industry, which – with its understanding of risk and modelling – is ideally positioned,” said Cunliffe of AXA XL, adding that insurers are indeed responding to a combination of factors such as brand, reputation and needs of their clients.

Managing risks and having a positive impact on the environment are two key reasons for the insurance industry to address ocean economy-related issues.

Managing risks and having a positive impact on the environment are two key reasons for the insurance industry to address ocean economy-related issues.

“The insurance industry can act as a key enabler for sustainable development,” concluded Bacani. “We have a symbiotic relationship with the ocean. To solve our climate and biodiversity crises, we also need to protect the ocean.”

“The insurance industry can act as a key enabler for sustainable development” said Butch Bacani of the UNEP FI Principles for Sustainable Insurance initiative Share on XThe UNEP Sustainable Blue Economy Finance Initiative was established with the aim to redirect financial flows and accelerate the transition to a sustainable blue economy. Building on the vision of leading banks, insurers and investors, UNEP FI’s Sustainable Blue Economy Finance Principles provide a guiding framework for sustainable finance of ocean sectors.

These principles represent the gold-standard to invest in the ocean economy and the initiative includes the participation of major insurers such as Aviva Investors, Willis Towers Watson, American Hellenic Hull Insurance and many more.

Learn more about how your organisation can get involved click here.

To watch the full recording of the webinar click here.