4 year anniversary

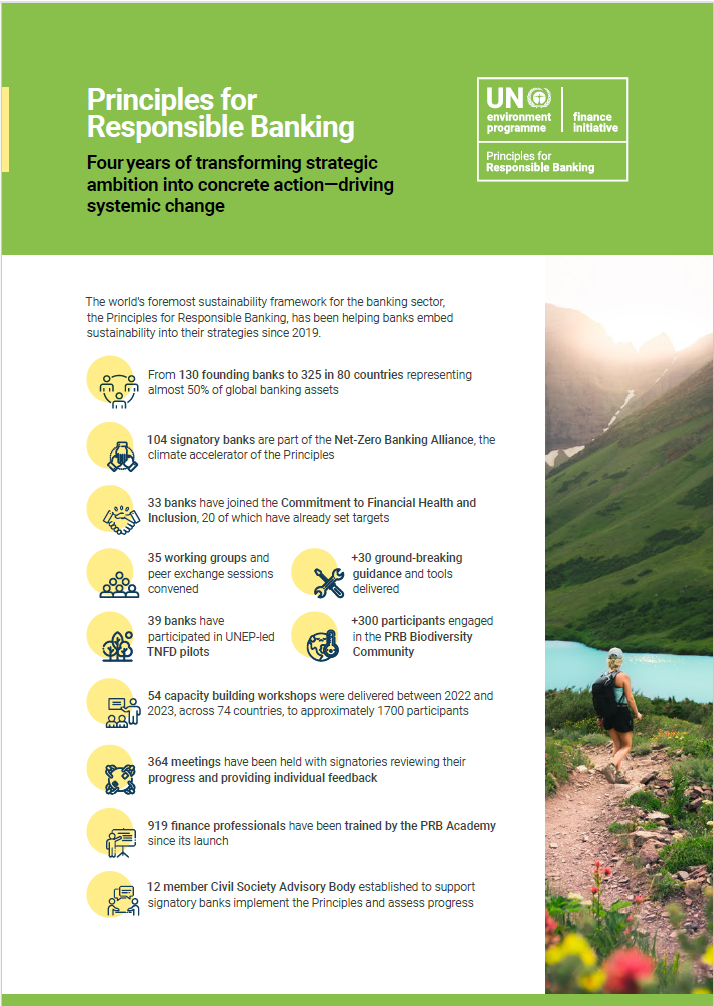

The Principles for Responsible Banking, the world’s foremost sustainability framework for the banking sector, is celebrating its 4th anniversary. The Principles are the world’s leading framework for responsible banking – unprecedented in their scale and scope, bringing banks across the world together to work on the most challenging and critical topics facing humanity and the environment.

Since the Principles for Responsible Banking were launched, the membership has seen remarkable growth from 130 founding banks to 325, representing almost 50% of the global banking industry by assets.

Implementing the PRB helps banks to future-proof their businesses by performing stronger risk management, undertaking portfolio impact assessment, and unlocking new business opportunities.

This comprehensive factsheet gives a brief overview of the key achievements during these first four years:

Hear from our members

About the Principles for Responsible Banking

The Principles provide a unique framework for embedding sustainability into bank’s strategies and transforming strategic ambition into action with concrete steps for operationalisation. Member banks benefit from step-by-step support guiding them along a clear implementation journey. The Principles are transforming the banking sector, driving real systemic change.

Since the establishment of the Principles, signatory banks have been working together to build the foundations, tools and industry guidance to forge pathways and guide the financial community towards the vision set out by the UN Sustainable Development Goals and the Paris Agreement on Climate.

The Principles provide a strong basis for convening topic-specific coalitions that provide leadership and accelerate action, like the Net-Zero Banking Alliance and the Financial Health and Inclusion Commitment.

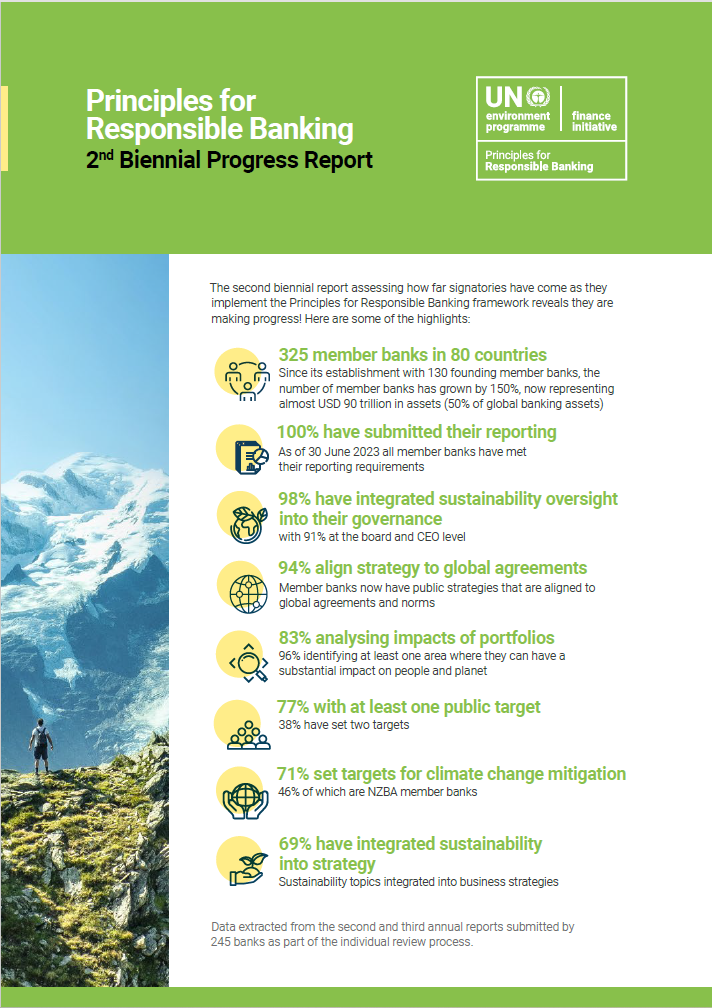

Second biennial progress report

Alongside the 4-year anniversary of the Principles, the second biennial progress report has been published. The report gives more insights on the work that has been done so far, what needs to be tackled next, and includes an independent review from the PRB Civil Society Advisory Body.

Member banks have made considerable progress understanding and disclosing how their portfolios and businesses relate to key environmental and social impacts. the majority of member banks have set targets to address their most significant portfolio impact, driving alignment with and contributing to the UN Sustainable Development Goals and the goals of the Paris Agreement.

Member banks have integrated sustainability oversight into their governance structures, primarily at the board and CEO levels, evidencing effective governance for embedding sustainability across the entire organisation. Almost all members have established public strategies aligned with the SDGs and the Paris Agreement. They offer sustainable finance products and engage with select clients to meet climate targets.

This comprehensive factsheet gives a brief overview of the PRB progress report:

To read the full PRB progress report, click here.

Looking to the future

While progress has been made by signatory banks, there is still more to be done. Banks are encouraged to build upon governance and structural changes to drive concrete action, realising more real-world impact while respecting national regulations, cultural norms, and contextual variations. This includes continuing to set ambitious public targets in impact areas including climate change (mitigation and adaptation), nature, human rights, resource efficiency, and economic inclusion, and focusing on implementing those targets in order to drive systemic change.

To support signatories, UNEP FI will continue to collaborate with banks on their Principles for Responsible Banking journey, working together at the forefront of sustainability topics, breaking new ground, and co-create new and pragmatic approaches that have the standing, robustness and legitimacy to shape industry practice worldwide.

New guidance on nature and climate change adaptation is expected to be released in Q4 2023.