As part of the Adapt’Action Facility, the United Nations Environment Programme Finance Initiative (UNEP FI), the Agence Française de Développement Group (AFD and Expertise France), the Eastern Caribbean Central Bank (ECCB) and the Organisation of Eastern Caribbean States (OECS) delivered a series of online training workshops on “Integrating climate-related financial risks” aimed at the Eastern Caribbean region (Anguilla, Antigua and Barbuda, The Commonwealth of Dominica, Grenada, Montserrat, Saint Christopher (St Kitts) and Nevis, Nevis, Saint Lucia, Saint Vincent and the Grenadines). The training was delivered in English, from March to October 2021.

Objective:

- Analyze the importance of potential climate financial risks (and opportunities) and impacts of climate change and Network for Greening the Financial System (NGFS)/ Task Force on Climate Related Financial Disclosures (TCFD) recommendations.

- Support the Eastern Caribbean Central Bank (ECCB), National Regulators and National Development Banks (NDB) in building their climate risks indicators according to the NGFS and TCFD recommendations.

- Enable the ECCB, National Regulators and NDB to include climate-related issues in their strategic plans and engage the construction of dedicated tools.

List of participating institutions:

Single Regulatory Units (9)

- Anguilla Financial Services Commission – Anguilla

- Financial Services Regulatory Commission – Antigua and Barbuda

- Financial Services Unit – The Commonwealth of Dominica

- Grenada Authority for the Regulation of Financial Institutions – Grenada

- Montserrat Financial Services – Montserrat

- Financial Services Regulatory Commission – Saint Christopher (St Kitts) and Nevis

- Nevis Financial Services (Regulation and Supervision) Department – Nevis

- Financial Services Regulatory Authority – Saint Lucia

- Financial Services Authority – Saint Vincent and the Grenadines

Development Banks (6)

- Anguilla Development Board – Anguilla

- Antigua & Barbuda Development Bank – Antigua and Barbuda

- Dominica Agricultural Industrial and Development Bank – The Commonwealth of Dominica

- Grenada Development Bank – Grenada

- Development Bank of St Kitts & Nevis – Saint Christopher (St Kitts) and Nevis

- Saint Lucia Development Bank – Saint Lucia

Other institutions (4)

- Eastern Caribbean Securities Regulatory Commission (ECSRC)

- Eastern Caribbean Central Bank (ECCB)

- French Development Agency (AFD)

- Organisation of the Eastern Caribbean States (OECS)

Training Calendar:

26 March 2021: Awareness-raising workshop

7 May 2021: Training session on “building risk indicators”.

2 July 2021: Training session on “building prudential standards”.

10 September 2021: Training session on “reporting and disclosure”.

October 2021: Closing session.

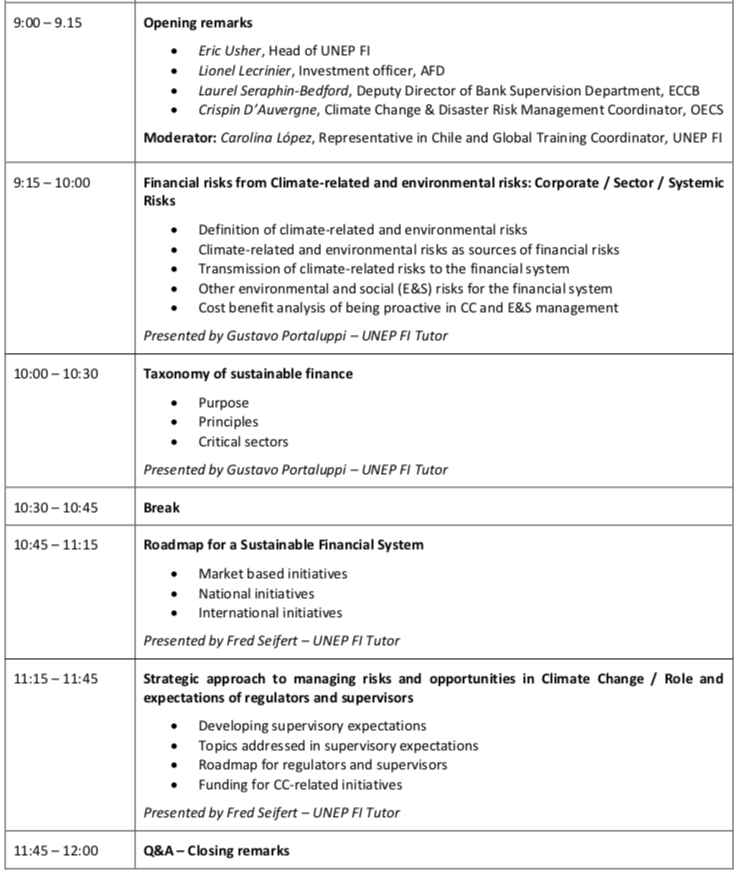

Agenda – 26 March 2021: Awareness-raising workshop

Learning objectives Webinar 1 – Awareness Session

- Generate better awareness and understanding of why climate risks matter for banks

- Develop knowledge of how the financial industry is trying to address climate risks

- Discuss the different qualitative and quantitative approaches to integrate climate risk into the credit analysis methodology

- Gain understanding of the importance of counting with an adequate taxonomy, as a tool for classifying sustainable activities

- Analyze different initiatives implemented by the Financial System to facilitate the transition path to a greener economy.

- Evaluate how to develop a mechanism to transmit supervisors / regulators expectations regarding climate risk management.

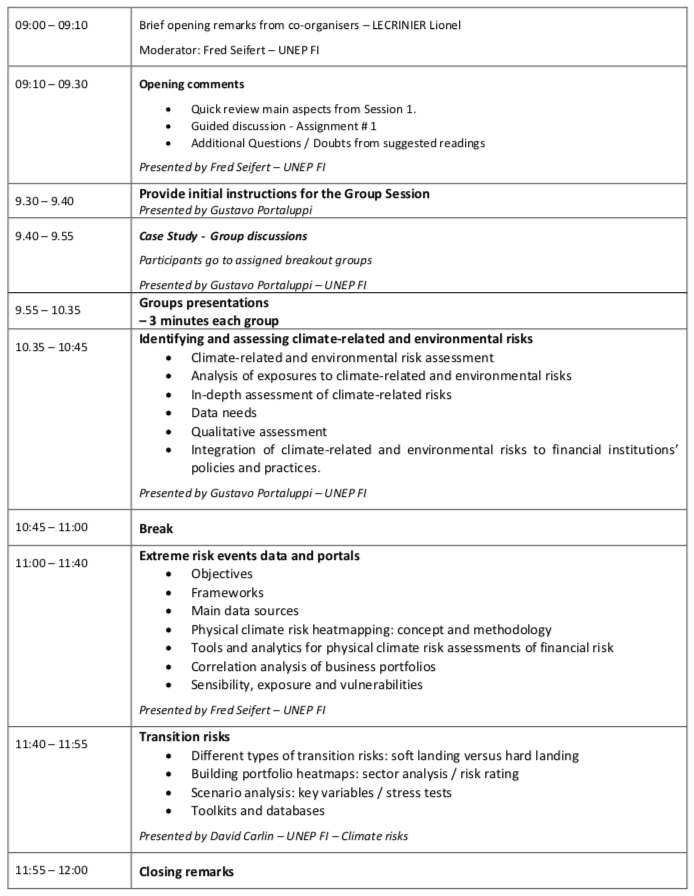

Agenda – May 2021: Training session on “building risk indicators”

Learning objectives Webinar 2 – Building risk Indicators

- Discuss the different strategies to integrate qualitative and quantitative climate risk analysis into current risk evaluation methodology

- Gain understanding of available data portals and databases related to physical and transition risks

- Analyze different initiatives that could be implemented at local level to facilitate the road to transition to a low carbon economy.

- Evaluate how to develop a sound monitoring scheme by supervisors / regulators regarding climate risk management applying climate risk indicators

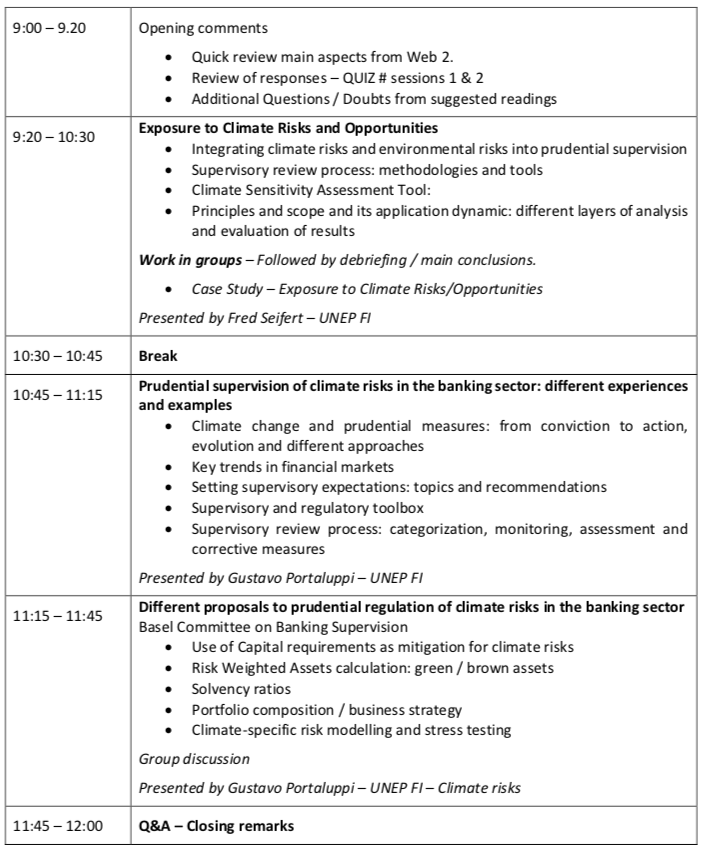

Agenda – 2 July 2021: Training session on “building prudential standards”

Learning objectives Webinar 3 – Building prudential standards

- Analyze global financial sectors views and different approaches to integrating climate and environmental risk into prudential supervision

- Evaluate how financial actors (banks, supervisors and regulators) are implementing new strategies and processes to manage climate related risks.

- Discuss the evolution and potential changes in prudential regimes aiming at integrating climate related risks in risk management, scenario analysis capital treatment and disclosure in financial institutions.

- Gain a better understanding of recommended methodologies and tools to assess potential impacts and risk profile of financial institutions vis a vis climate related physical and transition risks

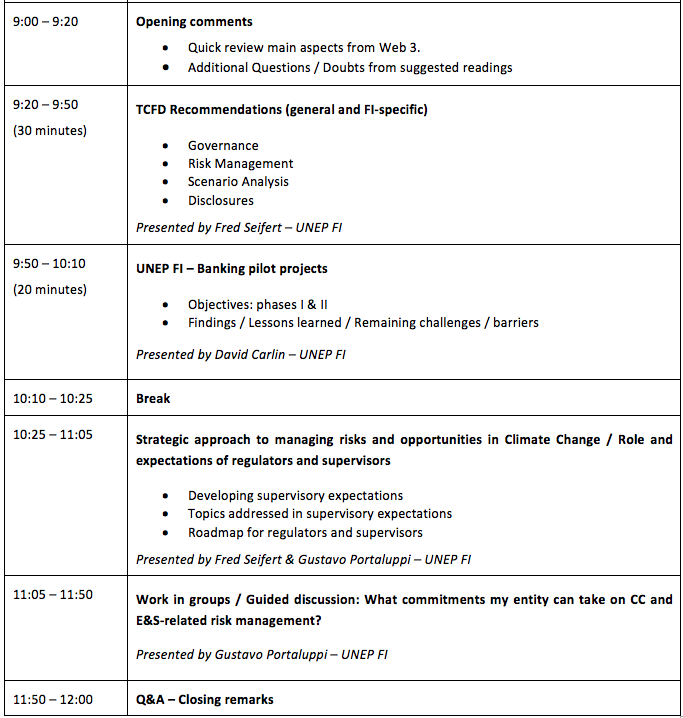

Agenda – 10 September 2021: Training session on Reporting and disclosure

Learning objectives Webinar 4 – Reporting and disclosure

- Gain a better understanding of existing requirements to disclose information on material risks in line with Basel III´s Pillar 3 regarding disclosures and TCFD´s recommendations.

- Evaluate how to prepare a financial system-wide strategic roadmap to improve climate related risks and opportunities disclosures.

- Discuss how climate-related financial risks and opportunities should be reported by FIs to meet the needs of different financial stakeholders, including the process of determining whether these risks are considered material or principal risks, while maintaining consistency and transparency.

- Analyze how reporting and disclosure by FI´s should evolve to make the information provided as insightful as possible, showing that climate related risks and opportunities are adequately understood and managed.

- Discuss pros and cons of making reporting and disclosures by FI´s mandatory or voluntary.

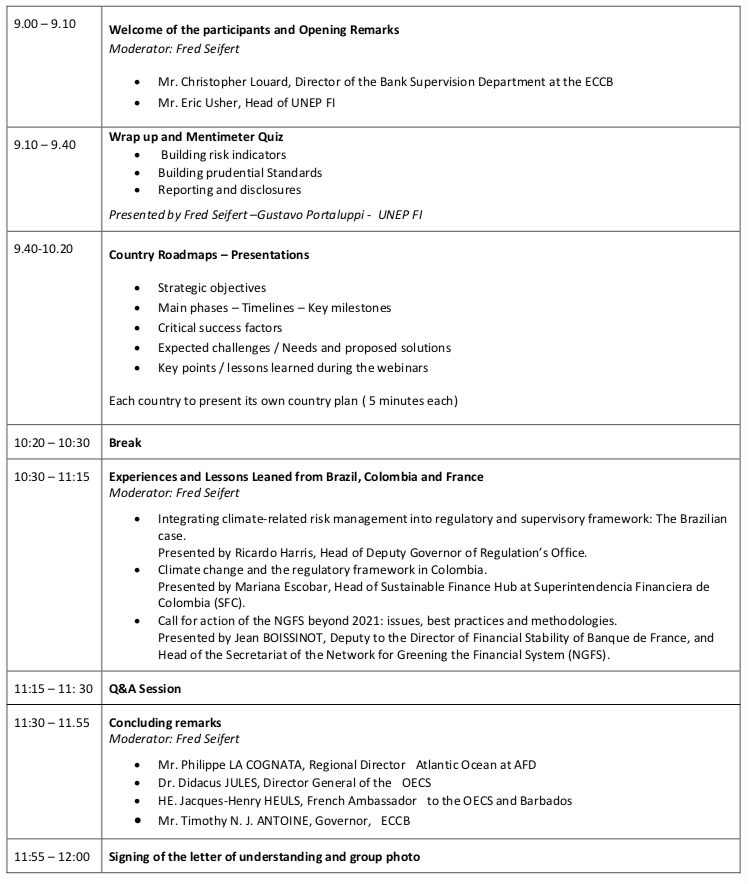

Agenda – 29 October 2021: Closing session

(Spanish)

INTEGRACIÓN DE LOS RIESGOS FINANCIEROS RELACIONADOS CON EL CLIMA EN EL CARIBE ORIENTAL

En el marco de la Adapt’Action Facility, la Iniciativa Financiera del Programa de Naciones Unidas para el Medio Ambiente (UNEP FI), la Agencia Francesa de Desarrollo (AFD y Expertise France), el Banco Central del Caribe Oriental (ECCB) y la Organización de Estados del Caribe Oriental (OECS) impartieron una serie de talleres de capacitación en línea sobre la “integración de los riesgos financieros relacionados con el clima”, dirigidos a los reguladores financieros y bancos nacionales de desarrollo de la región del Caribe Oriental (Anguila, Antigua y Barbuda, Dominica, Granada, Montserrat, San Cristóbal y Nieves, Nieves, Santa Lucía, San Vicente y las Granadinas). La capacitación se impartió en inglés, durante el período de marzo a octubre de 2021.

Objetivo:

- Analizar la importancia de los posibles riesgos (y oportunidades) financieros climáticos y los impactos del cambio climático, así como las recomendaciones de la Red para Ecologizar el Sistema Financiero (Network for Greening the Financial System, NGFS)/ Grupo de Trabajo sobre las Divulgaciones Financieras relacionadas con el Clima (Task Force on Climate Related Financial Disclosures, TCFD).

- Apoyar al Banco Central del Caribe Oriental (ECCB, por sus siglas en inglés), a los reguladores nacionales y a los bancos nacionales de desarrollo en la construcción de sus indicadores de riesgos climáticos de acuerdo con las recomendaciones del NGFS y del TCFD.

- Permitir que el Banco Central del Caribe Oriental, los reguladores nacionales y los bancos nacionales de desarrollo incluyan las cuestiones relacionadas con el clima en sus planes estratégicos y emprendan la construcción de herramientas específicas.

Lista de Instituciones participantes:

Unidades de Regulación Únicas (9)

- Comisión de Servicios Financieros de Anguila – Anguila

- Comisión Reguladora de los Servicios Financieros – Antigua y Barbuda

- Unidad de Servicios Financieros – Dominica

- Autoridad de Granada para la Regulación de las Instituciones Financieras – Granada

- Servicios Financieros de Montserrat – Montserrat

- Comisión Reguladora de los Servicios Financieros – San Cristóbal y Nieves

- Departamento de Servicios Financieros de Nieves (Regulación y Supervisión) – Nieves

- Autoridad Reguladora de los Servicios Financieros – Santa Lucía

- Autoridad de Servicios Financieros – San Vicente y las Granadinas

Bancos de Desarrollo (6)

- Junta de Desarrollo de Anguila – Anguila

- Banco de Desarrollo de Antigua y Barbuda – Antigua y Barbuda

- Banco Agrícola Industrial y de Desarrollo de Dominica – Dominica

- Banco de Desarrollo de Granada – Granada

- Banco de Desarrollo de San Cristóbal y Nieves – San Cristóbal y Nieves

- Banco de Desarrollo de Santa Lucía – Santa Lucía

Otras instituciones (4)

- Comisión Reguladora de Valores del Caribe Oriental (ECSRC)

- Banco Central del Caribe Oriental (ECCB)

- Agencia Francesa de Desarrollo (AFD)

- Organización de los Estados del Caribe Oriental (OECS)

Calendario de capacitación:

26 marzo 2021: Taller de sensibilización

7 mayo 2021: Sesión de capacitación sobre “construcción de indicadores de riesgo”

2 julio 2021: Sesión de capacitación sobre “construcción de normas prudenciales”

10 septiembre 2021: Sesión de capacitación sobre “información y divulgación”

Octubre 2021: Sesión de clausura

Organisers/Organizadores:

For further information please contact/Para más información por favor contacte con: