The UNEP FI Regional Roundtable for Latin America and Caribbean was held virtually from 31 August – 2 September 2021, and welcomed 1100+ participants and 40+ speakers to help define the role of banking, insurance and investment in shaping ambitious responsible and sustainable strategies to proactively address the challenges and opportunities of a green recovery whilst transitioning to a low-carbon, inclusive and sustainable future. All sessions were held in Spanish and Portuguese, with some sessions also in English.

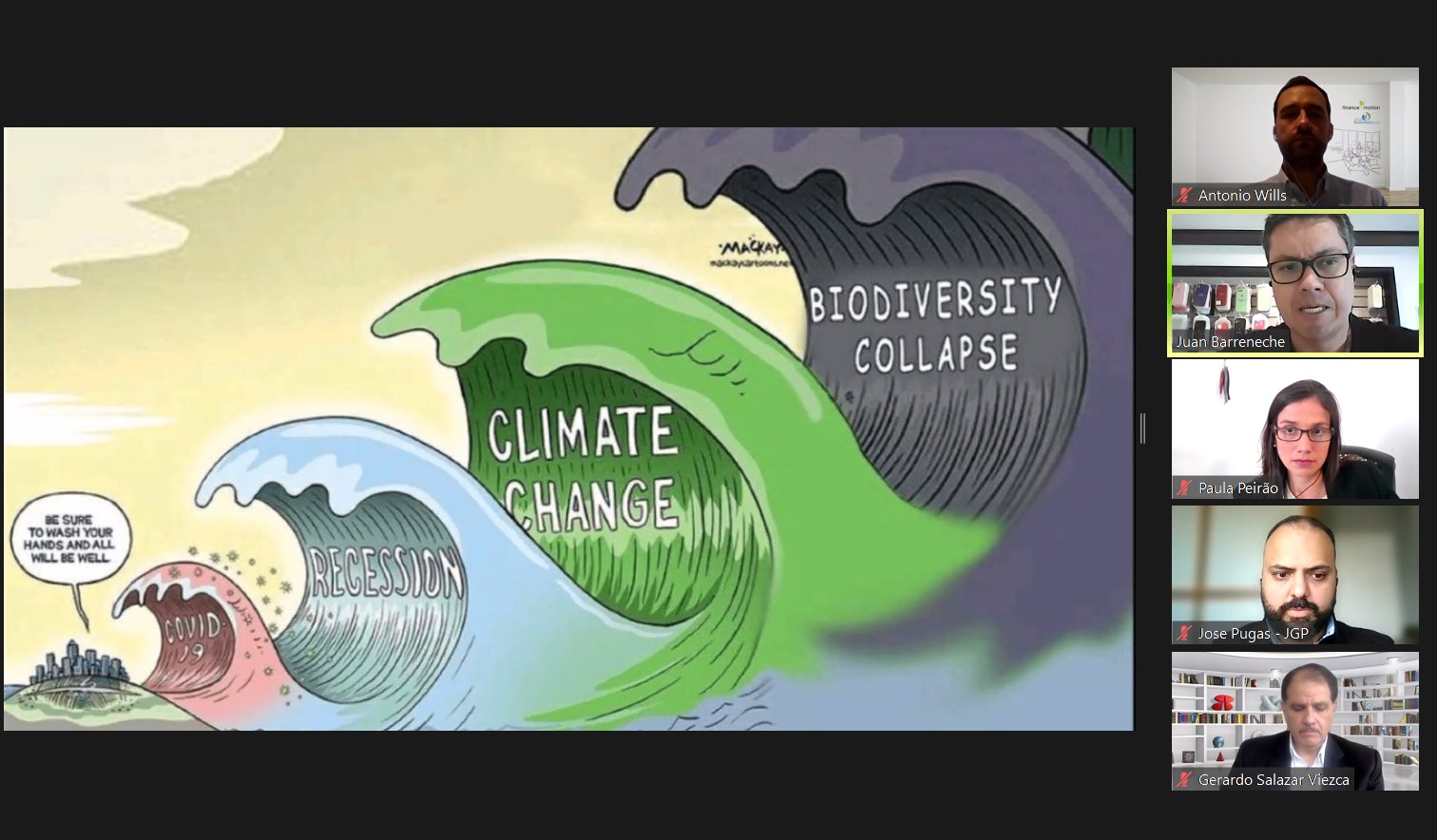

The Roundtable started with a discussion on greening the financial system from a regulatory perspective. Panellists discussed the role regulators have in creating green protocols that normalize integrating climate risk, biodiversity targets, and social risk into financial sector decision making. They highlighted the importance of creating laws and regulatory frameworks that seek to protect the environment and assisting financial institutions in aligning their agendas to environmental goals and designing the tools and mechanisms to encourage greening of the financial system such as green bonds, sustainability reporting and disclosure processes, amongst others. The panel stressed the importance of regulators collaborating with different financial actors, educating financial sectors on sustainability issues, providing data on sustainability metrics, whilst making recommendations to the finance industry to meet their environmental goals.

Watch recordings: English | Spanish | Portuguese

The next session saw three banking and insurance CEOs from the region discuss the challenges and opportunities the financial sector faces in Latin America and Caribbean in achieving net-zero goals. The panel highlighted the different regulatory frameworks in place aimed at helping financial intuitions meet these goals while also discussing the validity and efficacy of new public policies, target setting, and climate risk. They also contextualized the challenges specific to Latin America and the Caribbean from other net-zero efforts globally whilst stressing the business opportunities in the region.

Watch recordings: Spanish | Portuguese

The first day of the Roundtable ended with a session focused on using different data instruments to analyse ESG risks that are of concern to financial actors. Panellists provided an overview of the ESG integration processes of their different organisations and the extent to which they integrate the usage of data into decision-making processes as well as the overall ESG and sustainability strategies and programs of their institutions. They highlighted some of the obstacles that exist in using data to address ESG risks including the lack of coverage, the timeliness for which data is obtained, the lack of “actionable” data, and the need for more professionals with the technical expertise to work with the available data.

Watch recordings: Spanish | Portuguese

The next day of the Roundtable began with a panel looking at mapping the next decade of ocean finance and the Sustainable Blue Economy. Panelists emphasized the importance of blue economy as a provider of key ecosystem services whilst identifying climate related risks it requires protection against. They then discussed how the finance industry play a role in mainstreaming the blue economy through the funding of restoring projects, insurance mechanisms to protect ocean resources and the integration of blue practices into existing instruments whilst developing new financial mechanisms to better protect ocean health. They stressed the urgent need for public-private sector collaboration, stronger data for decision making, global frameworks, as well as guidelines for developing investments to stimulate activity on the blue economy that see returns for financial actors.

Watch recordings: English | Spanish | Portuguese

The next panel focused on aligning portfolios and setting targets for meeting nature and biodiversity goals. Discussions revolved around strategies to integrate natural capital into financial systems including assisting financial institutions in shifting to business models that integrate sustainable practices, whilst providing financing to projects that transition to economic models that incorporate biodiversity protection and align with the SDGs. The panellists emphasized collaborating with clients to help them constantly identify and manage risks through monitoring indicators and implementing robust risk managements systems built upon an understanding of impact and compliance with environmental legislation. They agree that blended finance opportunities, green credit lines, and rewards should be available to those seeking to protect biodiversity in order to encourage the timely creation and transition to a regenerative economy.

Watch recordings: English | Spanish | Portuguese

The final panel on day two explored the role of finance institutions in financing a circular economy. The panel first explained the key characteristics of a circular economy namely ensuring value of natural resources are not diminished as it moves along production chain and the reduction of waste. They highlighted how finance institutions can show leadership in transitioning to a circular model which encourages sustainability. They also emphasized challenging clients by demonstrating the opportunities available by transitioning to circular economy and providing more consistent funding for those trying to foster a circular business model including in the form of available credits and new products and innovations. A key point they stressed is the role of finance institutions, with the help of regulatory assistance, as a liaison between different stakeholders along the production chain through funding to optimize the flow of resources.

Watch recordings: English | Spanish | Portuguese

The third day of the Roundtable began with a session on promoting financial health and inclusion for a resilient society. Panellists discussed the importance of making financial inclusion and health a core business purpose for finance institutions in policy and oversight as they are vital to meet sustainable development goals and ensure those excluded from the financial system have equal opportunities. They discussed closing financing gaps and expanding financial offerings and services ensuring it is more accessible with fairer rates, flexible contracts, and increased consumer protection with sustainable social development and a green economy in mind. The panel stressed the importance of promoting financial education through trainings, public-private partnerships, the sharing of data, and the help of regulators with technology having a big role to play in the diffusion of this information.

Watch recordings: English | Spanish | Portuguese

Carrying on the theme of financial inclusion, the next session tackled aligning gender targets and equality with international frameworks. The panel discussed the role of the financial industry in creating and offering products and services to women to close the gender gap. Speakers articulated why gender equality matters to their respective organizations and the importance of disaggregating data. They highlighted the importance of including low-income women, a group often overlooked by the finance industry, into the financial system to provide them better opportunities and the necessary innovations needed for finance institutions to assist in make further progress closing the gender and equality gap.

Watch recordings: Spanish | Portuguese

The final session of the Latin America and Caribbean Regional Roundtable focused on promoting access to insurance and using insurance to meet the SDGs. The panellists provided what in their view were the major challenges and opportunities in the industry when it comes to providing broad access to insurance in a vector of greater adherence to practices that will lead to achieving the SDGs. They stressed the role of the insurance sector in helping combat different crises like COVID-19 and climate change. Finally, they touched upon the offering of inclusive insurance to small and medium enterprises and what insurers can do to provide relevant climate risk management offerings.

Watch recordings: Spanish | Portuguese