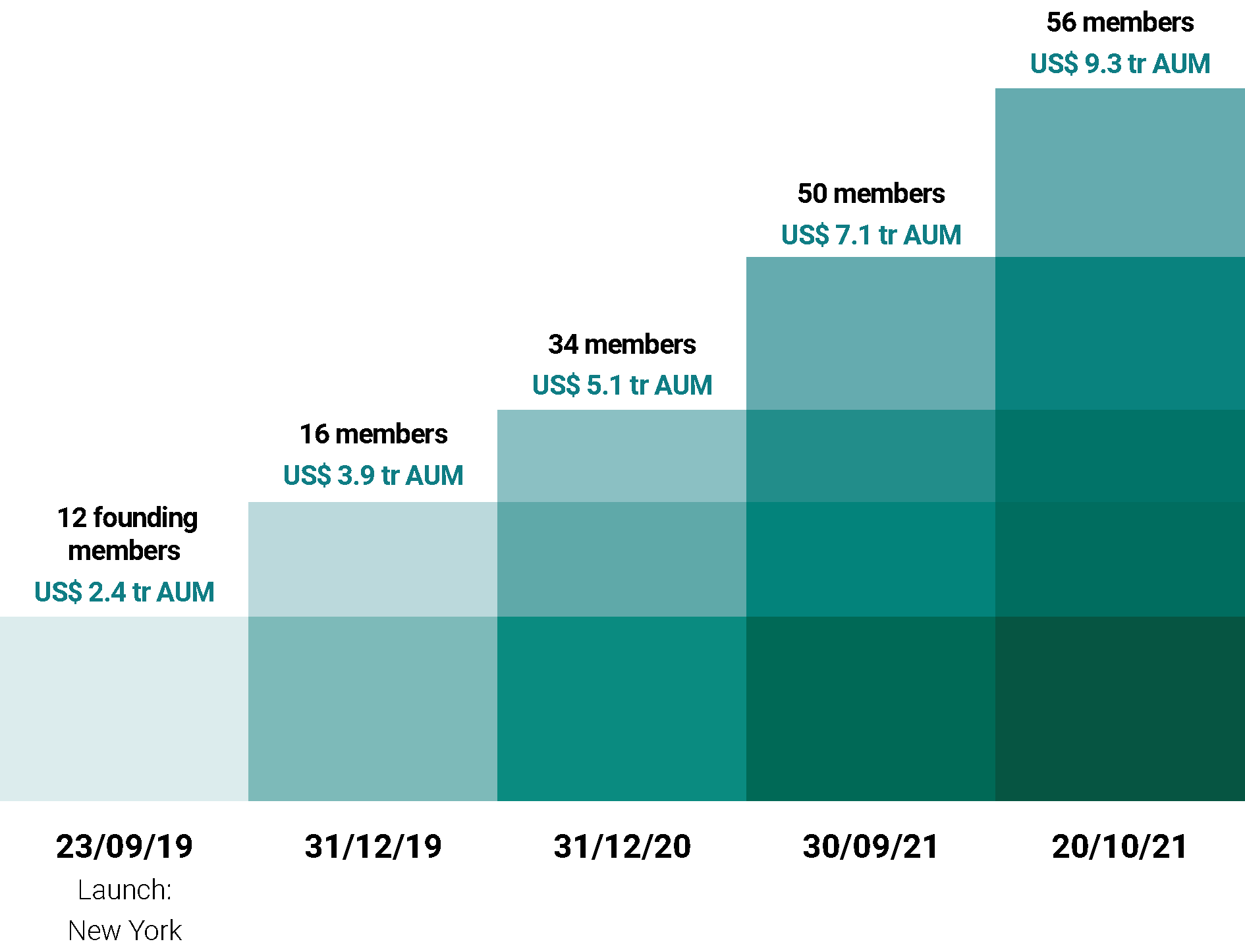

The UN-convened Net-Zero Asset Owner Alliance was launched at the UN Secretary-General’s Climate Action Summit in 2019 and only celebrated its second anniversary in September 2021. However, faced with the gargantuan task of decarbonizing their portfolios and the real economy by 2050, Alliance members doubled in 2021 and quickly became leaders in net-zero finance.

In 2021, Alliance members were the first in the industry to set science-based five-year interim targets and engage with complex policy issues such as carbon pricing – solidifying their position as industry role models and sources of thought leadership. In 2022, the Alliance will further increase target ambition, work on additional pressing policy issues and grow in its size and regional scope.

The Sixth Assessment Report of the International Panel on Climate Change (IPCC), served as a wake-up call to all, as it reminded us that to have an 80% chance to limit warming to 1.5oC, we have a carbon budget of around 300 billion tonnes of CO2 (GtCO2)—at scale of just 7 years of 2020 emissions.[1] There is no time to delay global action and the net-zero transition of the economy. As Günther Thallinger, Member of the Board of Management of Allianz SE and the Chair of the Alliance put it:

“Climate change is not a problem that can be put off. It is here, and the impacts are already too costly for people and the planet. Decisive advances must be taken this decade to hit the mid-century target of 1.5°C. The damage climate change will end up doing depends on the human response over the next few years. Further delays mean dramatically more harm and a vastly more costly bill to make up for the lost time.”

Alliance members are leading members of the Glasgow Financial Alliance for Net Zero (GFANZ), representing half of the world’s institutional assets (over US$ 130 trillion of private capital). Private finance has been front and center of the 26th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP 26) which even integrated a Finance Day within its official agenda; as Remco Fischer, the UNEP FI Climate Lead framed it: “one of the successes of COP 26 was that an unprecedented number of public and private sector actors stepped forward with a promise to lead.”

As we approach the countdown to 2022, we share with you our most inspiring highlights through key figures.

10 trillion in assets under management

Importantly, we are not the only ones. In 2021, the Net-Zero Banking Alliance and the Net-Zero Insurance Alliance came into existence and the Net Zero Asset Managers Initiative further increased in size. These are real testaments of the transformative momentum within the financial industry.

29 members have set their interim targets

As Günther Thallinger evoked during a WWF-organized COP 26 side event, what “builds credibility” in net-zero commitments are “science-based interim targets.” The Allianz is the first industry initiative to publicly publish targets for 2025. Submitted by 29 members, and expected to be met by FY2024, interim targets have been aggregated in the inaugural Progress report, published in October 2021.

On the sub-portfolio target, the members on average went beyond the recommended reduction range (-16% to -29%). The sub-portfolio target encompasses the greenhouse gas (GHG) emissions of the underlying holdings for those asset classes where there are robust tracking methodologies: listed equities, publicly traded corporate bonds and real estate.

80% of all carbon emissions remain outside pricing mechanisms—the Alliance argues for a global pricing corridor

In particular, the discussion paper recommends that all countries put in place a carbon-pricing corridor where the floor and ceiling prices rise over time. It also points out that to meet net-zero targets, the current carbon prices will need to almost treble by 2030 and complimentary policy mechanisms, such as scaling investments in renewable power systems, will need to be implemented in parallel.

7 or more Gt of CO2 per year will need to be removed from the atmosphere to keep global average warming to 1.5°C

To align with 1.5°C, the primary focus must remain on deep decarbonization in energy, urban, infrastructure and industrial systems, as well as on reversing emissions growth from land use systems. However, the Alliance recognizes – just like the IPCC — that carbon dioxide removal (CDR) technologies can be used “to compensate for greenhouse gas emissions from sectors that cannot completely decarbonize, or which may take a long time to do so.”[2]

Moreover, to keep global average warming to 1.5°C, CDR solutions will need to remove 0.5 to 1.2 Gt of CO2 per year by 2025, and as much as 6 to 10 Gt of CO2 per year by 2050.[3] For comparison, current global greenhouse gas emissions are equivalent to over 40 GtCO2. Thus, CDR solutions, both nature-based and technological, will need to be developed at scale. The Net In Net Zero position paper, published in September 2021, calls for asset owners to facilitate the transition to a deep and rapid decarbonization across all sectors by investing into activities, technologies, and nature-based solutions that remove residual emissions.

6 possible solutions to overcoming barriers to scale blended finance

Due to its ability to de-risk investment in climate solutions and clean technology through public or philanthropic capital, blended finance can help direct much needed private capital to Emerging Markets (EMs) and Least Developed Countries (LDCs). Meaning, blended finance can help close the funding gap in climate investment. This is why the Alliance published a Call to Action to Asset Manager to Support Blended Finance in March 2021. To provide an overview of the main obstacles deterring investment, and offer potential solutions, the Alliance also released the Scaling Blended Finance discussion paper.

Elevated risk perception, restricted market access, and the lack of data transparency are all highlighted as key obstacles to investment. To overcome the obstacles, the discussion paper proposes the following 6 solutions and invites readers to further engage on the topic:

- Enhancing the universe of investable projects and building capacity among all actors and stakeholders

- Making private sector investment in funds eligible for official development assistance (ODA)

- Pooling donor funds and standardizing investment

- Revising the incentives model of DFIs

- Generating data points to be made available and accessible

- Establishing ratings methodologies.

5 members have been (re)elected to the Steering Group

The Alliance’s Steering Group (SG) is composed of C-suite level executives from member organizations as well as convening organizations. Elected every two years by all asset owners, the Steering Group convenes quarterly and sets the strategic direction of the Alliance. The Chairperson of the Alliance is elected by the Steering Group members. The SG that will assume its roles and responsibilities in January of 2022 has the following composition:

| Asia-Pacific | Africa | North America | Europe | Non-regional | UNEP FI | PRI |

|---|---|---|---|---|---|---|

| Stephan van Vliet, CIO of Prudential | Lesley Ndlovu, CEO of African Risk Capacity | Charles Émond, CEO of CDPQ | Günther Thallinger, CIO of Allianz (Chair) | Torben Möger Petersen, CEO of PensionDanmark | Eric Usher, Head | David Atkin, CEO |

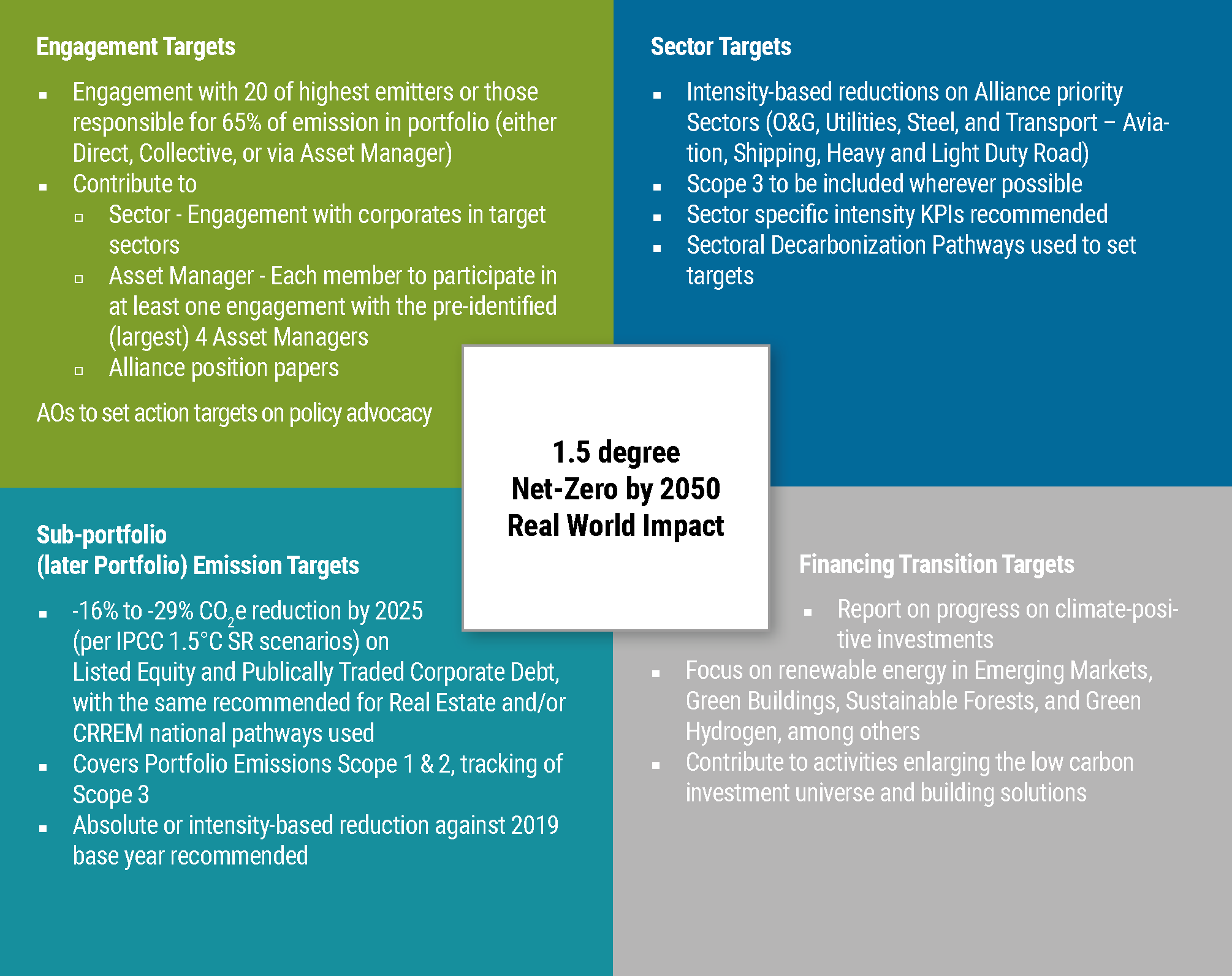

4 types of targets that Alliance members report on

The backbone of the Alliance’s monitoring and engagement work lies in the 2025 Alliance Target Setting Protocol, which guides how members set science-based emission reduction targets, achievable in the next five years. Aligned with the IPCC 1.5°C no- and low-overshoot pathways and driven by the aim to drive impact in the real economy, the Protocol outlines a structure consisting of 4 different target types: sub-portfolio, sector, engagement, and financing transition. Based on developments in carbon tracking methodologies and the need to represent as many asset classes as possible, a second volume of the Protocol will be published in early 2022.

3 new Japanese members and the first African member

Since the Alliance seeks to make a global impact, it is acutely aware of the importance of a wide regional representation in its membership. This is why the Alliance was particularly proud when, following the joining of Dai-ichi Life Insurance Company in March 2021, it welcomed three new members from the Asian financial market: Nippon Life, Sumitomo Life, and Meiji Yasuda Life Insurance. Together, the Japanese insurers manage assets of US$ 1.4 trillion. Since this year, the Alliance also counts among its membership a first African institution: African Risk Capacity Ltd, a specialized agency of the African Union.

2 times being called the “gold standard” at COP 26 by the UN Secretary General

In 2022, the Alliance is taking on the responsibility of further justifying the reputation of the “gold standard” for setting net-zero targets. In his speech at both the COP 26 Opening and Closing Plenary session, the UN Secretary General, António Guterres, reminded that “net-zero emission pledges require rapid cuts this decade,” in his words: “every country, every city, every company, every financial institution must radically, credibly and verifiably reduce their emissions and decarbonize their portfolios starting now.” This is why Alliance members are required to report on their progress every year and the second Progress Report will include new members’ targets as well as assessment of advancement on the targets already set by the 29 first movers.

Over US$ 1 trillion already in motion towards a 1.5°C aligned target by 2025

According to the inaugural Progress Report, the Alliance’s members have already put the first US$ 1.5 trillion in motion towards a 1.5°C aligned target by 2025. However, it is undeniable that this amount could be higher with the inclusion of additional asset classes. This is why at present the Alliance continues pressing ahead and working to introduce infrastructure and other asset classes into its target-setting framework over the next 12 months, as well as sovereign debt accounting.

[1] IPCC (October 2021). Climate Change 2021: The Physical Science Basis. Summary for Policymakers.

[2] IPCC (n.d.). FAQ on Chapter 4.

[3] Coalition for Negative Emissions (June 2021). The Case for Negative Emissions, a call for immediate, supported by McKinsey & Company.

About the UN-convened Net-Zero Asset Owner Alliance

The 66 members of the UN-convened Net-Zero Asset Owner Alliance have committed i) to transitioning their investment portfolios to net-zero GHG emissions by 2050 consistent with a maximum temperature rise of 1.5°C above pre-industrial levels; ii) to establishing intermediate targets every five years; and iii) to regularly reporting on progress. The Alliance is convened by UNEP’s Finance Initiative and the Principles for Responsible Investment (PRI). The Alliance is supported by WWF and Global Optimism, an initiative led by Christiana Figueres, former Executive Secretary of the United Nations Framework Convention on Climate Change (UNFCCC).

About UNEP FI

United Nations Environment Programme Finance Initiative (UNEP FI) is a partnership between UNEP and the global financial sector to mobilize private sector finance for sustainable development. UNEP FI works with more than 400 members – banks, insurers, and investors – and over 100 supporting institutions – to help create a financial sector that serves people and the planet while delivering positive impacts. UNEP FI aims to inspire, inform and enable financial institutions to improve people’s quality of life without compromising that of future generations. By leveraging the UN’s role, UNEP FI accelerates sustainable finance.

About the UN Environment Programme (UNEP)

UNEP is the leading global voice on the environment. It provides leadership and encourages partnership in caring for the environment by inspiring, informing, and enabling nations and peoples to improve their quality of life without compromising that of future generations.