2025 marks a very special year for the UN Principles for Responsible Banking (PRB). Over 350 institutions, representing ~50% of global banking assets, are now choosing to implement the PRB as a comprehensive means of addressing sustainability risks, managing impacts, and leveraging market opportunities.

In our third biennial Progress Report, we evidence a sector-wide shift in banking practices — showcasing how responsible banking leadership is not only benefiting clients and shareholders, but is also beginning to deliver tangible impacts on the real economy and society.

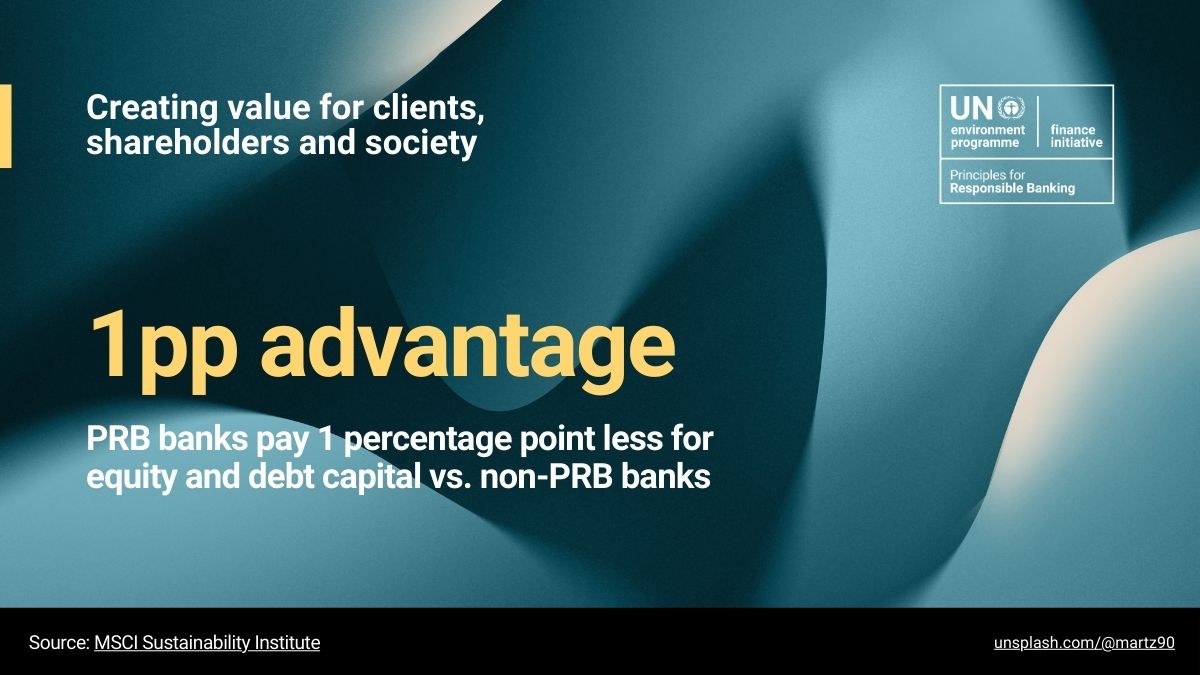

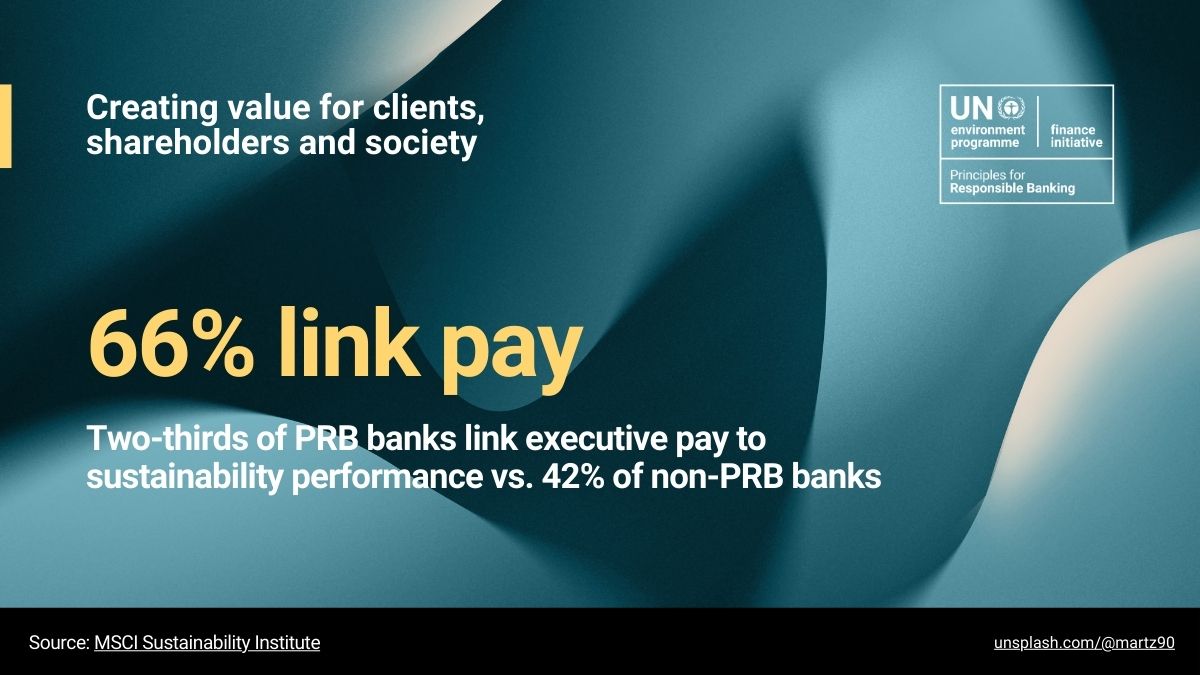

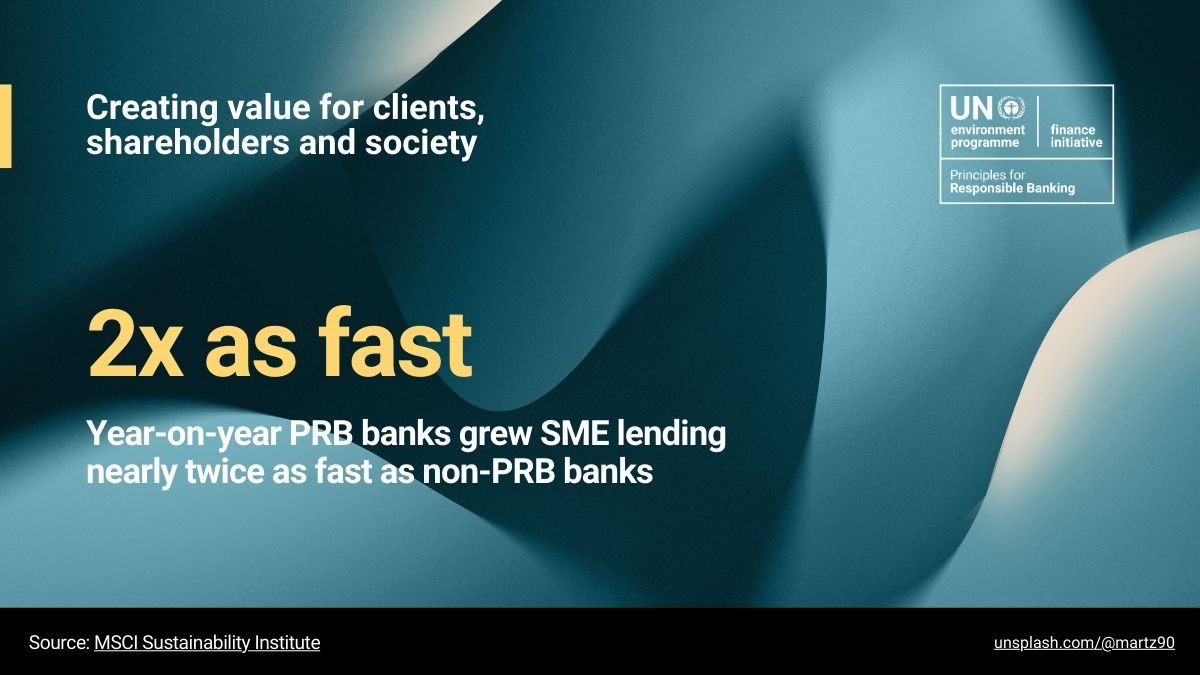

Spotlighting compelling, original research from MSCI, we note that 61% of PRB signatory banks are rated sustainability leaders vs. 23% of non-signatories. Moreover, the same study found that PRB signatories enjoy a lower cost of capital, averaging a 1 percentage point advantage over peers.

Celebrate #6YearsofthePRB — the world’s preeminent sustainable banking framework.

“Six years on, the Principles for Responsible Banking continue to help UNEP FI member banks embed sustainability into their core business strategies, creating value for clients, shareholders and society. We celebrate the impactful progress our signatory banks have already made, knowing that to achieve a resilient, low-carbon, and inclusive global economy requires coordinated action from governments, industry, and civil society — and thus our work must continue.”

Eric Usher, Head, UNEP FI

Progress Report – Responsible Banking: A Six Year Journey of Systemic Change

Launched on 15 October, the PRB’s third biennial report showcases a sector-wide shift in banking practices. The report provides bespoke data and analysis demonstrating how PRB signatories are increasingly moving from commitment to action, embedding sustainability into core business strategies, governance, and client relationships to manage risk, meet stakeholder expectations, and remain competitive in an evolving economy.

Highlights include:

- Banks representing circa 50% of global banking assets embedding sustainability into strategy, governance and client relationships

- MSCI analysis shows PRB banks paid one percentage point less, on average, for equity and debt capital

- Growing regulatory momentum for market practices pioneered by UNEP FI

Download and explore this rich resource here.

Six Years of the Principles for Responsible Banking

Click to view the full infographic to commemorate six years of Principles for Responsible Banking progress.