NEW: Version 3 of the Portfolio Impact Analysis Tool for Banks is now complete!

November 2022

As of 2022, UNEP FI’s Impact Analysis Tools are gradually transitioning to a ‘modular’ format, where the different components of impact analysis are contained within distinct modules. Discover all modules of Version 3 of the Portfolio Impact Analysis Tools for Banks!

The Portfolio Impact Analysis Tools for Banks is an iterative input-output workflow based on UNEP FI’s unique Holistic Impact Methodology. The Tool requires users to input data to describe their portfolio and to reflect their current impact performance. The Tool then uses the input data in combination with a set of in-built Impact Mappings to produce a number of outputs, in particular a set of impact profiles by business line, and to guide the user in identifying the bank’s most significant impact areas and determining priorities, thus setting the basis for strategy development and target-setting.

The Tool is designed to enable banks to comply with the requirements under Principle 2 on Impact Analysis and Target-setting of the Principles for Responsible Banking (PRB): ‘We will continuously increase our positive impacts while reducing the negative impacts on, and managing the risks to, people and the environment resulting from our activities, products and services. To this end, we will set and publish targets where we can have the most significant impacts.’

Modules of the Portfolio Impact Analysis Tools for Banks (Version 3):

- Context Module – Download here

- Consumer Banking / Identification Module – Download here

- Consumer Banking / Assessment Module – Download here

- Institutional Banking / Identification Module – Download here

- Institutional Banking / Assessment Module – Download here

⚠ Warning

- The Tool is a “live tool” that actively incorporates user feedback; we recommend that you frequently check the website for updates to ensure you have the latest version.

About the new, modular format

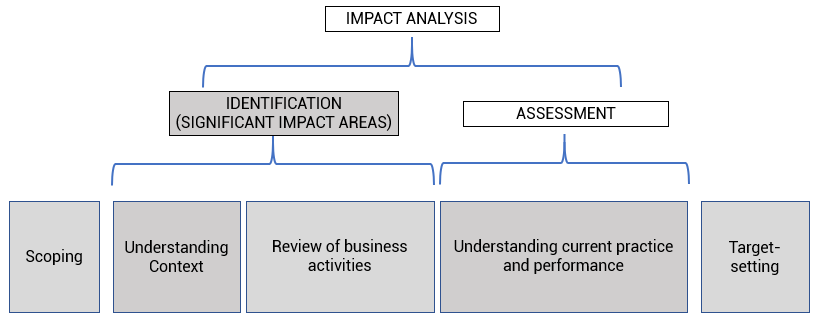

The Portfolio Impact Analysis Tool has transitioned to a ‘modular’ format (Version 3), where the different components of the impact management process (as per the UNEP FI Impact Protocol) are contained within distinct modules, as per the diagramme below.

This new modular format allows more flexibility to accommodate a variety of types of user banks.

Other exciting new features of Version 3:

- The impact areas and mappings in the Tool are those listed and described in the revised Impact Radar (July 2022)

- Enhanced user-friendliness / quicker navigation thanks to lighter file size

- Increased capacity (sector selection)

- The Context Module enables needs assessment at three different levels: global, country and local

- New data visualisations, including SDG correspondences

- Sector selection remains possible in a variety of industry classification codes (ANZIC, ISIC, NACE, NAICS)

Additional Resources

- Find a presentation of all Tool Modules here

- Watch a walk-through of the Tool Modules:

- Download the demo versions of the Tool Modules:

- If you would like to access previous versions of the Tool, please get in touch here

FAQs

Will the other Impact Analysis Tools (Investment Portfolios, Corporate and Real Estate) be shifted to a modular format?

Yes, all the Tools will be shifted to a modular format. The Corporate Impact Analysis Tool is next in line to be shifted.

Who has access to the Portfolio Tool for Banks? How many banks are currently using it?

The Tools and User Guides are open source, available for free and can be used and implemented by anyone who would be interested. However, members of the Principle of Responsible Banking (PRB) and UNEP FI are benefitted from implementation support, workshops and continual working group meetings and consultations.

Approximately half of UNEP FI’s PRB signatories (which account for more than 290 banks across the world) are currently using the Portfolio Impact Analysis Tool for banks.

Feedback

Are you using V3? What has your experience been like? Share your feedback with the UNEP FI Secretariat and check the website regularly for updates! The adjustments will be listed so you can keep track of what is changing.

Contacts

- Costanza Ghera, Content Manager – costanza.ghera@un.org

- Alexander Stopp, Content Manager – alexander.stopp@un.org

Copyright © United Nations Environment Programme, 2022

The UNEP FI Portfolio Impact Analysis Tools for Banks and its User Guides may be reproduced in whole or in part and in any form for non-commercial educational or non-profit purposes without special permission from the copyright holder, provided acknowledgement of the source is made. Please contact the United Nations Environment Programme for a tailored acknowledgement statement. The United Nations Environment Programme would appreciate receiving an electronic copy of any materials (publications, resources, tools) that use all or part of this resource either directly or as a source of inspiration.

No use of the UNEP FI Portfolio Impact Analysis Tools for Banks and its User Guides may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the United Nations Environment Programme.

Disclaimer

The conclusions derived by users regarding their most significant Impact Areas and areas of priorities are their own. Only the Tool methodology can be attributed to UNEP FI.